在此处更改您的语言和 LGT 位置。

私人客户的数字平台

登入 LGT 智能银行

金融中介机构的数字平台

登入 LGT 智能银行 Pro

常见问题解答 (FAQ)

LGT 智能银行帮助

常见问题解答 (FAQ)

LGT 智能银行专业版帮助

Investors are increasingly investing in companies for reasons that go beyond just making money. Engaging in long-term dialogues could replace the vociferous conflicts seen in the past.

"Love it or leave it": if shareholders feel that a company they are invested in is not living up to its potential, they can divest. But they can also actively engage in order to change the situation.

And that is what we will be considering in this article: how investors can influence companies to drive positive change. In addition to legal rights, we will share some interesting real-life examples with you and explain developments that are underway in private banking that aim to give investors a greater say.

Over the centuries, a number of different legal entities have emerged. Among other things, these entities determine how a company's shareholders can exert influence. Today, shareholders in a stock corporation in Switzerland, for example, have a range of proprietary and membership rights that they can exercise.

Investors who trust a company's management and are hoping that its approach will result in financial gain will be particularly interested in proprietary rights. These relate to the payment of dividends, for example.

Investors who are more skeptical of a company's management and demand that significant changes be undertaken are more likely to want to gain influence by means of certain membership rights.

Among others, participation rights govern shareholders' participation and voting or proposal rights at the general meeting of a stock corporation.

Information and control rights include not only the right to obtain information through the annual and audit reports. They also determine, for example, how shareholders can obtain or request information about the company over and above these reports.

The right of action determines, among other things, how shareholders can take legal action to enforce their claims in the event of a conflict, and the extent to which a company is responsible to its shareholders.

In private banking, these rights all too often are not exercised. "To date, private investors have only exercised these rights occasionally," says Christopher Greenwald, Head of Sustainable Investing at LGT.

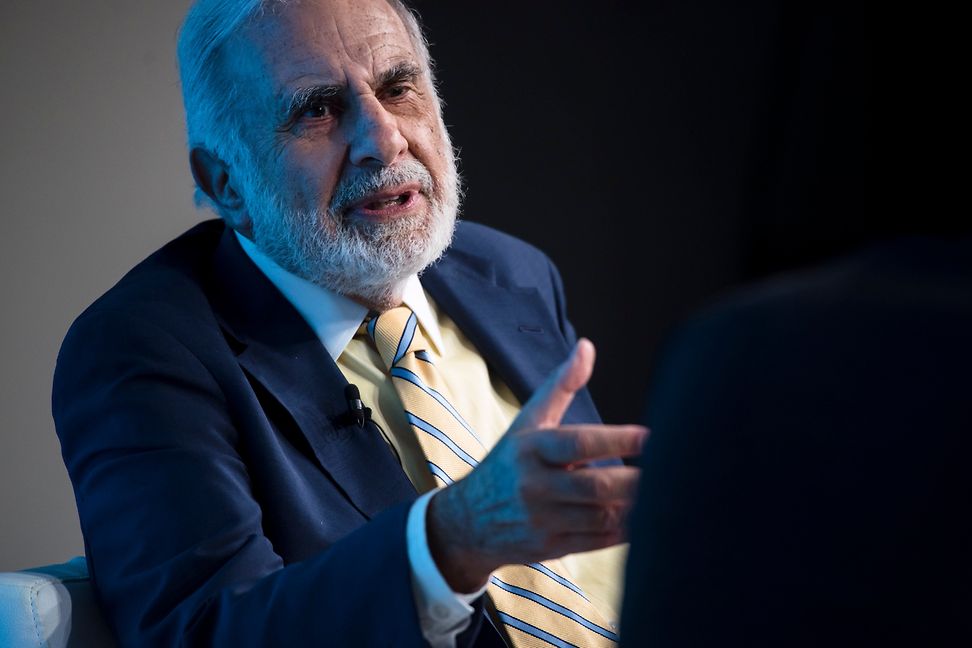

Activist investors such as Carl Icahn and Nelson Peltz have earned a fortune by making targeted investments in undervalued companies. After acquiring a stake, they urge the company's management to drastically change course or they convince shareholders to demand changes on the board of directors. If the company’s value rises sharply as a result, they realize a profit.

Carl Icahn is perhaps the most prominent activist investor, and has earned himself the dubious title of corporate raider - Forbes still reverently describes him as "America's Most Feared Trader". Despite the fact that his approach is criticized by many, he and other activist investors serve as role models for many of today's hedge funds.

Activists from across the political spectrum, for example civil rights groups, or supporters of the peace movement or environmental protection, have developed a different form of activist investing. They also seek to challenge management, albeit with a view to achieving political rather than monetary goals. In the 1980s, they realized that shareholder rights gave them access to the podium at the annual general meetings of listed companies, enabling them to draw the attention of shareholders as well as the general public to their concerns.

Despite their very different world views, both of these types of activist investors pursue a confrontational approach when it comes to exposing management’s shortcomings or forcing management changes. But there are more constructive ways for investors to engage with companies that have emerged over the past several years.

The rise in shareholder engagement has emerged in parallel with the recent significant growth in sustainable investing. This movement has been led by large, institutional investors, and has pursued a more collaborative approach to engagement focusing on improving both a company's impact on the environment, society and its corporate governance (ESG) while simultaneously improving its financial performance.

"Institutional investors are currently taking the lead when it comes to sustainable investing," says LGT's Christopher Greenwald. These investors focus on engaging in an active dialogue with the companies in which they are invested. They take a constructive approach to supporting companies on their path to optimization and improvement - which is why this type of influence is referred to as "stewardship."

Being involved in a company as an active owner is a long-term undertaking in which improving the company's sustainability performance plays a central role. In order to share their concerns more effectively, institutional investors have increasingly worked to coordinate their requests through so-called collaborative shareholder engagement. In order to scale engagement activities, investors have also increasing pursued the stewardship services of specialized service providers, which then also consolidate the requests of numerous investors. So why have private investors not made more use of these forms of engagement to date? "That's exactly where we see an opportunity," says Christopher Greenwald.

"Stewardship services can help private investors accelerate and scale the impact of their sustainable investments, which is why at LGT, we are working to expand our offering to clients in this area," says Greenwald. As part of this process, LGT is focusing on collaborating and further developing sustainability standards together with other financial institutions.

LGT is now a member of Climate Action 100+, for example. This is the largest global investor initiative on climate change, and it aims to encourage the world's biggest greenhouse gas emitters to reduce their emissions across the value chain. It has also introduced other measures that are designed to help companies improve their climate reporting or to manage better their climate-related risks.

Another important element of LGT's shift to greater engagement is its collaboration with the stewardship service provider Columbia Threadneedle Investments (formerly BMO Global Asset Management (EMEA)). Since launching Europe's first social and environmentally screened fund in 1984, Columbia Threadneedle Investments has made a name for itself, particularly among institutional investors, as a reliable partner actively engaging with companies on ESG issues for more than 20 years, seeking an ongoing dialogue with management.

LGT's clients with a strong interest in sustainable investing have the possibility to include their assets in Columbia Threadneedle Investments' engagement activities. LGT is one of the first private banks in Europe to offer clients this service. The overall importance of collaboration to drive successful engagements was recently shown in an academic study published several years as part of a scientific study on active ownership.

"For our clients who are invested in a sustainable portfolio, we want our partner Columbia Threadneedle Investments' engagement service to be a standard for clients focused on sustainable investing," says Christopher Greenwald (LGT). This way, clients can be sure that sustainability criteria will be addressed in a systematic dialogue with a company's top management. It is also envisioned that voting rights will be increasingly exercised across strategies. The new opportunities will be available to clients who are invested in the new focus sustainability funds being launched by LGT, thereby contributing to the increasing importance of stewardship for sustainable investing in private banking.