- Home

-

Private banking

-

LGT career

Companies should be measured not only on their quarterly profits, but also on their contribution to society, says Harvard economist Oliver Hart.

Are investors really only in it for the money? Are things like climate change, societal harmony and clean air by-the-by, as long as they get their returns? Not at all, claims Harvard economist Oliver Hart, winner of the 2016 Nobel Memorial Prize in Economic Sciences. The 74-year-old British expert sees investors as the driving force behind a fundamental economic shift that will make our world a better place.

In a detailed interview at the most recent Lindau Nobel Laureate Meeting Hart explains why the time has come to recalculate the balance sheet for companies—and in doing so go far beyond profit and market value. He also describes what responsible investing looks like, and why he believes it would be wrong to only hold shares in companies that already conduct their business in an exemplary manner.

Professor Hart, how would you explain the trend that is seeing companies and their top-level managers becoming increasingly held accountable in terms of their responsibilities toward the environment and society?

I think there are a few possible explanations. One factor is certainly climate change, which is becoming an increasing concern for younger people in particular. You also have pressure from employees and consumers, and of course, some investors are responding to that – not necessarily because they themselves have a developed a greater interest in social responsibility, but they’re saying, “If we want our company to be profitable, we have to be concerned with ESG. Because the people we sell our product to are.”

So it comes down to pragmatism?

There’s also the feeling that governments are not dealing with the problems. And I think that feeling has grown, particularly in the case of climate change, because it’s a worldwide phenomenon. No government can overcome this challenge alone, and it is often hard enough to gain a consensus on a national level. Getting multiple governments to work together seems incredibly hard. So people get frustrated by politicians not solving problems. And if we think government is failing, why wouldn’t we be attracted by other possible solutions?

And that’s why companies are being held to account?

I do not for a moment think that companies can solve all our problems. But I think that’s one of the reasons that people are putting pressure on companies: government failure.

What does this mean for top-level managers?

Many CEOs claim that ESG is an important topic for them. They often see it as a win-win situation and say: “This is what our customers want, so it’s in our best interest.” But they never want to talk about trade-offs, and I think that’s wrong. There’s absolutely no reason to think that, in general, what’s good for society is also good for the bottom line. Sometimes your own interests will align with the greater good, sometimes not. That’s just the way it is, and we have to recognize that.

Does that mean that the era of everyone looking at profit alone is over? The theory put forward by the economist Milton Friedman in his famous 1970 New York Times article, that “the social responsibility of business is to increase its profits” has held for decades.

Friedman’s argument sounded very appealing to many people. The idea is that companies should concentrate on business and maximizing profit because they do not have a comparative advantage in doing good relative to individuals. Therefore it is better for companies to make their shareholders wealthy so that they in turn can use this wealth to do good on a private level. And that makes a lot of sense. The conclusion was very attractive, that’s why many people adopted it – until in the last few years more and more of them have begun to realize, “You know, what? Actually that isn’t logically correct.”

Why not? Where does the theory fall down?

There are some situations where companies are in a unique position either to do good or avoid harm. For example, take a chemical company that decides to release poisonous waste water into a river – or not to. This is not something that individual shareholders can prevent, and they cannot easily act upon the consequences either.

In addition, it’s much more expensive to clean up environmental damage than preventing the pollution in the first place. Thus, socially minded shareholders may prefer the company not to pollute even if this reduces dividends. It might seem obvious, but many who believed Friedman’s theory missed this side of the argument – including myself.

Selecting particular companies, and excluding other ones, is a very indirect way of getting a better world.

Can the trend towards ESG investing really make a difference now?

Many investors say: “I want to invest in good companies and I want to divest from the bad ones, or not invest in them in the first place.” In my view that is a very questionable strategy, not least because it immediately raises the question of what is a “good” company? A lot of people are arguing about the topic of greenwashing when funds or companies pretend to be green, but in reality don’t meet the promised standards. Another important point is that selecting particular companies, and excluding other ones, is a very indirect way of getting a better world.

How do you mean?

I think it is much more powerful to engage with companies directly – including the dirty ones – and motivate them to change their minds. In a recent scientific paper named Exit vs. Voice, my co-authors Eleonora Broccardo, Luigi Zingales and I compare investment strategies when it comes to dealing with dirty companies. In essence, there are two reasons for an individual to invest only in clean companies. One is: “I just feel better. I sleep well at night again because I’m not part of the dirty system.”

That’s understandable, don’t you think?

There’s something to that, but does it actually have an effect? The other common idea is: “I’m going separate myself from dirty companies because I want to encourage them to become cleaner – because if they don’t, they’re losing a lot of shareholders as well.”

Sounds logical.

Yes, but that is a very indirect way of effecting change. Because there are plenty of less socially responsible people who will buy up those shares. Like certain hedge funds that basically say: “Great, this is a buying opportunity for us!” So it really doesn’t have an impact. Because if you get out of the dirty companies who’s going to be left? It will be the socially irresponsible people – who may be pushing the companies to be even dirtier.

Using your voting power, and passing shareholder resolutions or electing people to the board who are going to actually change the company – that, I think, is a much more powerful mechanism.

What should investors do instead if they really want to make a difference?

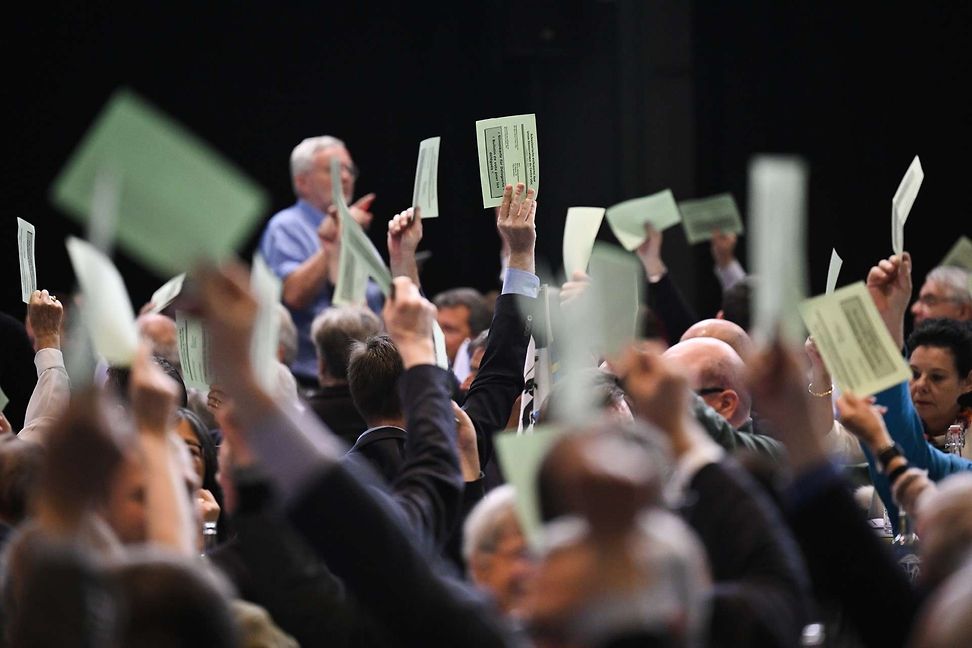

Engage with these companies and hold them responsible. Using your voting power, and passing shareholder resolutions or electing people to the board who are going to actually change the company – that, I think, is a much more powerful mechanism.

If we take this argument to its logical conclusion it would mean: “Buy as many shares in irresponsible companies as you can!”

Theoretically that would be nice, but in practice it would come with enormous risk. The extreme case would be that you buy the whole company and find out that it is no longer profitable once it stops polluting the environment. Now the company is clean, but you’ve made a huge capital loss. I don’t think people are that altruistic.

A more realistic approach seems to me that investors hold a little bit of a range of companies – including dirty ones. And when the next vote comes up, they use their voice to make a difference and push for change.

Aren’t shareholders mainly interested in a good dividend?

Maximizing the short-run financial return is a very narrow view to take. A broader view for long-term investors with a diversified portfolio would be, “Well, what about all the other companies I own?” This applies to institutional investors in particular, because when I invest in an index fund, I end up owning a small part of a great number of companies.

Now, if company X starts doing something that harms the environment, this might affect the business of company Y, which I also hold a stake in. And if we zoom out further, we might say: “I care not only about myself, but also about the greater good. So even if I’m not breathing in this bad air myself, maybe there are people in another part of the country that are. Shouldn’t I be concerned about that?” That’s the view that I personally like best.

Are you confident that many shareholders still see the greater good as a priority when their own finances are actually at stake?

In our paper, my co-authors and I look at a specific example. In 1984, the chemical giant DuPont in Michigan had to decide whether to continue releasing the toxic chemical PFOA, which was used to manufacture Teflon pans, into the Ohio River. The alternative was to incinerate the waste. The cost of incineration at the time was $19 million, but DuPont decided to continue polluting the river. In the end, this caused an estimated $350 million worth of damage to the local area. Now imagine that the shareholders had been asked what the company should do.

What would have been different?

It’s a simple calculation. If we assume that the costs of $19 million would have been distributed across 100 million shareholders, then the personal cost to each of them would have been 19 cents. Compared with the suffering this would have prevented – the illnesses, the saved lives – who would not be willing to pay 19 cents? You do not have to be a particularly altruistic person to choose the greater good in that sort of case.

Is it realistic for management decisions such as these to actually be put to a shareholder vote?

I think the general point is that diversified shareholders might be willing to sacrifice some profit for the greater good. You don’t even need to know the exact figures. If I’m bearing a very small part of the cost, then I’m probably going to be in favor of not polluting. This might seem optimistic, but I’m convinced that management could incorporate that idea in their own thinking and free themselves from the idea that their duty is only to maximize profit.

How could external, mostly hidden costs like in the case of DuPont be made visible?

I don’t have a good answer to that at the moment. But that doesn’t mean that there isn’t one. Once upon a time, profit and losses weren’t very well measured, but then – because everybody cared about it – accounting standards got better. Similarly, I think in the future, we may have better measures of carbon footprint and other ESG variables. We should never underestimate human ingenuity. In any case, I don’t think the answer is: because some of these things are hard to do, we should therefore ignore them.

As a diversified investor, you could transfer your voting rights to fund providers that share your goals.

If companies want to involve their shareholders more, they need to give them more in-depth information about the day-to-day activities of the business. Can we really expect shareholders to pay attention?

As a diversified investor, you probably don’t want to have to research every issue you’re asked to vote on in detail yourself. But you could, for example, transfer your voting rights to fund providers that share your goals. Some institutional investors already offer specialty guidelines. More generally speaking, a big step forward will be if institutions start to listen to their investors – which they may do simply to protect themselves. Right now in the US, pension funds and other institutional investors are increasingly caught in the crossfire of politics, and one way for them to respond is to say: “Okay, we will push the votes down to our investors, then we’re off the hook.” That means, even as a small investor, you may increasingly find you’re being encouraged to take an interest.

What should companies – and their managers – be measured on, if we were to look at more than just quarterly profits?

The fundamental question is how do we measure the contribution that companies make to society? And what should we maximize? Economic theory says that under certain conditions, this contribution can be determined from indicators such as profit and market capitalization. It’s a well-founded idea, but in many situations, the assumptions required for this don’t add up. And if you come to the conclusion that market value doesn’t represent the total contribution to the world, then you start thinking differently about it. I believe that we should stop seeing money as the be-all and end-all. We need a new narrative for the economy. I think we need to change our thinking all the way. Now!

LGT committed to sustainability early on. Long-term and sustainable thinking and actions have always been among the company’s strongest characteristics. LGT has therefore been working to further strengthen its commitment to sustainability both in its operations and in its core businesses, private banking and asset management, for many years now. It is important to LGT that its business activities make a positive contribution to the environment and society. You can learn about how it achieves this here.