- Home

-

Private banking

-

LGT career

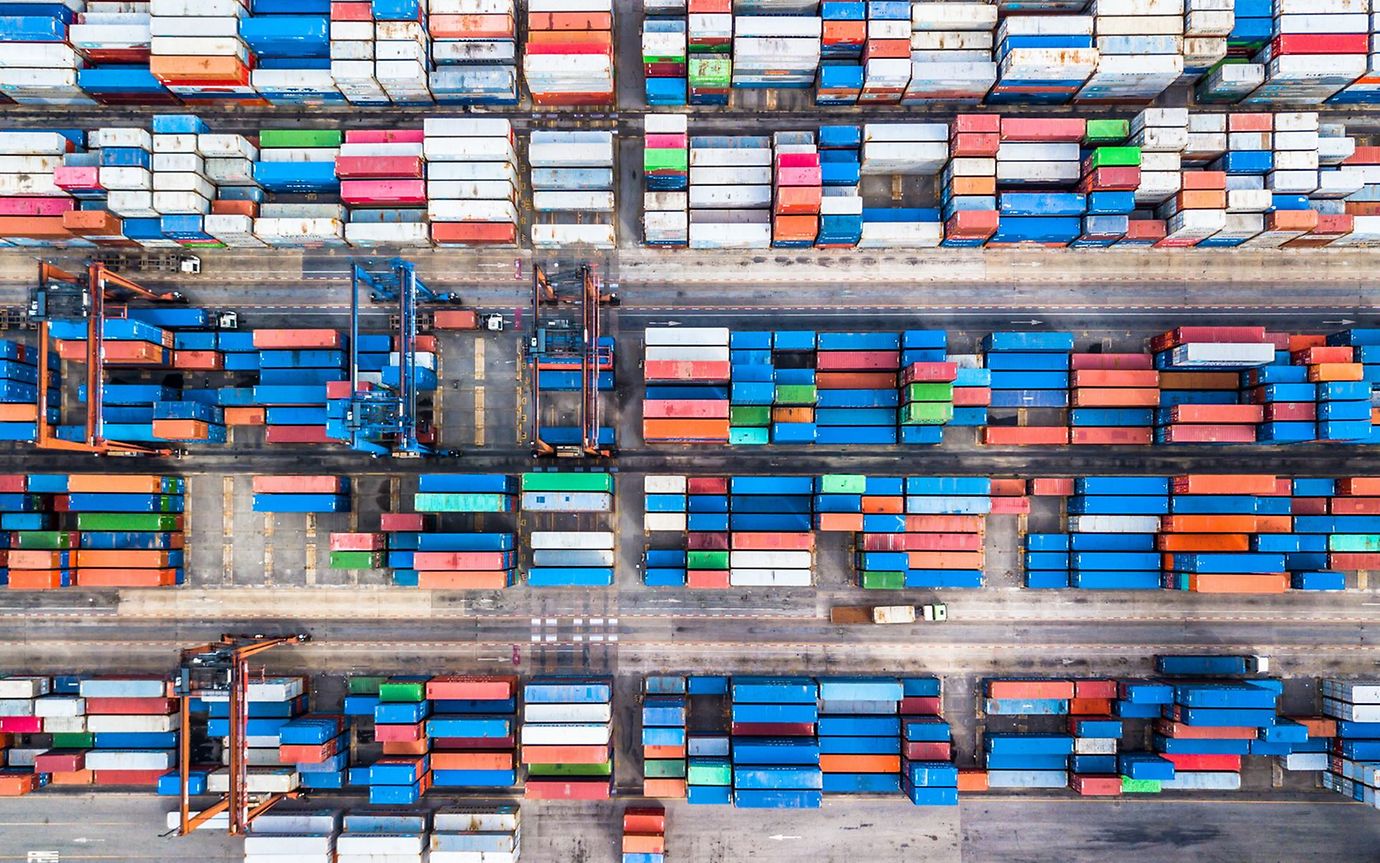

With businesses pouring money into creating more resilient international supply chains, and governments leaning towards trade protectionism, investors face new economic risks - but also significant opportunities.

We'd all like to start the new year with optimism, but there's no doubt that the Houthi attacks on tankers in the Red Sea are causing consternation to investors. This new transport bottleneck and the consequent rise in distribution costs and oil prices are definitely worrying, and offer the latest evidence of a new security reality facing businesses.

"Rising geopolitical tensions and the pandemic have highlighted the risk of over-reliance on key resources and production capacity abroad," says Reto Egli, Head of Fund Research EMEA at LGT. After several decades of rapid globalisation and expanding international trade and investment, companies and countries are now in the process of reversing this trend.

Today, economic security has top priority - even ahead of global growth. As companies work through the challenges posed by this, certain industries are likely to benefit significantly. The cybersecurity and defence industries, for example, are seeing strong investment flows, while reshoring and resource supply businesses will become more prominent in future.

Although the watershed events of the 2020s have shone a spotlight on economic security, in fact it isn't a new issue. Europe's longstanding dependence on imported oil, and the reliance of many US manufacturers on components imported from China, are just two examples of supply vulnerabilities.

Other risks have become apparent. Protectionism has been increasing slowly over the last decade, but there has been a huge jump in global trade restrictions since 2020. These sanctions are costly, both in time and money, and have exposed other fragilities in supply chains, including over-reliance on single sourcing for critical components and resources.

Even in developed economies, strengthening economic security is seen as too important to leave to the business community alone. Governments are getting involved too, investing record amounts in developing resilience in nationally sensitive businesses like manufacturing, defence, IT, and energy. "Resource security is now high on the political agenda," says Egli. "Recent geopolitical tensions have highlighted the risk that supplies of critical resources such as energy and key basic materials, previously thought to be secure, could suddenly become constrained."

Businesses able to create more diversified supply chains will benefit from government initiatives. Companies are also engaged in internal retooling projects to reduce their vulnerability to external shocks and strengthen their economic security. Onshoring or reshoring is fundamental to this. Whereas in the past, companies simply sought out the cheapest place to produce the components they needed, often offshoring manufacturing to a developing economy, now they are bringing some essential component manufacturing back to their home country, or distributing manufacturing between several markets.

Building or rebuilding manufacturing capacity in new places requires significant investment. Beneficiaries from this trend will be industrial equipment and automation manufacturers. Many companies in these industries have typically had quite cyclical profiles in the past, benefitting only during economic upturns, when corporate capital expenditure is high. "We believe that the current economic cycle will have a different impact on selected cyclical stocks than it has had in the past," says Egli. "This is because strong structural drivers, such as the ongoing reshoring trend, could significantly reduce the cyclicality of earnings in certain market segments."

Efforts to diversify energy supply fit well with the already well-developed decarbonisation agenda.

We can see a variation on this theme in the semiconductor industry. High-performance semiconductors are used in many everyday products, from smartphones, to laptops, to cars. But this crucial component is mainly produced in just one country: Taiwan. During the pandemic, semiconductors were in short supply because of global transport issues. The knock-on effect was significant production delays across myriad industries. By developing domestic semiconductor manufacturing capacity, and effectively reshoring a critical element of many supply chains, companies and governments hope to mitigate a significant economic security risk, not least in light of China-Taiwan tensions.

Energy is another area of concern, particularly in Europe, where many countries' long-term reliance on Russian oil was called into question in 2022. All across the continent, businesses and governments are looking at ways to diversify their sources of energy.

This effort fits in well with the already well-developed decarbonisation agenda. What's more, completing an effective transition to net zero will require diversified, stable supply chains to ensure access to the resources needed to achieve this (such as rare minerals for batteries).

Companies and governments are investing significant sums to shore up their economic and resource security in uncertain times. Mitigating international risks will help to stabilise global supply chains, increase economic security, and provide boosts to those companies and industries able to find effective solutions. But in a year when more than 70 states around the world are due to hold elections, it pays to remember that not all risks can be mitigated, particularly when changes in political leadership can introduce new uncertainties.

LGT’s experts analyze global economic and market trends on an ongoing basis. Our research publications on international financial markets, sectors and companies help you make informed investment decisions.