- Home

-

Private banking

-

LGT career

British entrepreneur, investor and podcaster Azeem Azhar explains why digital transformation was just the beginning of a fundamental economic transformation - and where the biggest opportunities for the future can be found.

With his "Exponential View" newsletter, British author, analyst and futurologist Azeem Azhar reaches more than 200,000 subscribers worldwide. Week after week, the economist analyzes future trends and describes the latest developments in various fields of science and business.

In his book "Exponential," published in fall 2021, Azhar summarizes his insights. For a Harvard Business Review podcast, Azhar regularly talks to founders, investors and academics about topics such as artificial intelligence, sustainability and works of the future. Azhar lives in London with his wife and three children. Karsten Lemm spoke with him for MAG/NET.

Mr. Azhar, you say we’ve entered a new era in human history, the “Exponential Age”. What does that mean?

Product performance is improving for any given cost and keeps accelerating. In consequence, it becomes cheaper and cheaper to get better and better products. That happens because we’re using fewer materials, we are miniaturizing and we’re modularizing with every generation of technologies. In essence, we are optimizing by learning.

Haven’t we always done that?

Yes, but the fact that we now have global networks of knowledge that we didn’t have 30 years ago makes a huge difference. If an idea shows up in a product in Shanghai on Tuesday, by Thursday someone has written about it and it’s being read by someone in Seville or San Francisco. And by the next week, they’ve taken that idea and put it into their own system.

That process accelerates very, very quickly. And it happens with physical products as well because we are able to source components from all over the world and push our requirements back to the manufacturers equally quickly. The internet and our globalized economy have been critical to this acceleration.

Where will we see the biggest impact of this trend?

We’re looking at a fundamental restructuring of the economy, so it’s very hard to single out specific industries. The potential impact is enormous everywhere. But if you look at key opportunities, one overriding requirement is the need to have decarbonized industrial processes. Another area with really high potential is synthetic biology. This field takes new approaches, such as the science of genomics, protein engineering and cell engineering, to more precisely reach specific outcomes.

For what purpose?

One outcome might be better therapeutics, which, of course, is a huge opportunity because a blockbuster drug is a multi-billion-dollar business. Other promising applications are how we produce food and industrial products. We know, for example, that nature creates materials that are good enough to sit on, because many of us have wooden chairs. The promise is to generate materials through synthetic biology that are even better but don’t involve cutting down forests. The potential is enormous. If I had to choose one area to spend all my time in it would be this intersection with biology, because I think that is the one which has the largest opportunity for really radical transformation.

Swiss startup Climeworks filters carbon dioxide from the air and turns it into stone.

How big are the markets we’re talking about?

A McKinsey estimate says that by 2030–2040, the scale of all of the products coming out of synthetic biology will be around $4 trillion a year – whether it’s in health care, food, materials or even microbes that can eat pollution, or systems that can take in carbon dioxide. It might take some time for us to get those techniques to scale but I think ultimately the opportunity will be much bigger than $4 trillion because the food industry alone is an $8 trillion industry globally.

Where does the transformative impact in the food sector come from?

What synthetic biology says is, “Look, we’ve got much, much better techniques than using cows to produce the proteins we want and need.” Because we know what the proteins are, we know what the mechanisms are. And we can start to brew and construct these proteins in fermentation tanks called bio reactors, in a way that’s similar to how a good old German brewer uses yeast, or the way that you create a tofu or other types of fungal-based protein.

Except it doesn’t sound nearly as appetizing as steak and beer.

The point is we’re creating the same meat that people want to eat, giving them the same nutrition. The way we currently create protein for eating is that we chop down lots of Brazilian rainforests, we then get cows – living, sentient beings – to very, very, very inefficiently eat grass that we have to water constantly. And the cows very inefficiently convert that grass into fat, carbohydrate and proteins. The animals exude methane into the atmosphere, and at some point, we come and take these animals and kill them. All of this involves an incredible amount of resource wastage and often cruelty to the animals as well.

Lab meat does not seem to follow your theory of exponential developments. It’s been in the headlines for years, but only on a few plates.

We can already produce meat in the lab at exceptional quality. But we can only produce very small volumes of it right now and the main question is, when does it get cheap enough? Currently it’s so much more expensive that even at 30 to 40 percent cost declines per year it’s still a few years away from being cost competitive to industrial mean farming. But I’m sure that it will get there. The outer limit is probably 10 years, but it could be much, much quicker than that.

Food production is closely related to fighting climate change. There’s a clear need to change consumption habits but little actual effort.

I have no doubt that battling climate change is going to be an absolutely enormous driver of innovation, for several reasons. One is that carbon pricing is going to come in and we’ll have a great need for technologies to manage the amount of carbon that’s already in the atmosphere but also to pull that out. In addition, we need technologies that help us be alert to climate risk, extreme weather, weather events, and mitigate against them. All these opportunities will make climate change a rallying point for innovators.

How do we bridge the gap between what we, as societies, need to do – and what we are doing?

You have to focus on the opportunities. There don’t really need to be a lot of trade-offs. Anyone who’s driven an electric car will tell you that it’s a better drive than an internal combustion engine car. That’s why satisfaction rates of people who own electric cars are much higher. And anyone who’s walked on a beach that isn’t covered in pollution will tell you it’s better than the one that is littered with plastic.

Is it a matter of sending the right message?

The beauty of tackling the sustainability challenge is that you get an “and, and, and”. We’ll see products that are cheaper, they are better, and they do deliver a better experience – all while being more sustainable. Now, underneath that is a lot of very difficult systems change that has to take place. But the thing that allows us to persuade more people is that the systems change pain is worth it for the result that you get.

How do we get this message across on a global level so that it actually has an impact?

The decision will get made by capital and by finance. Already today, the cost of capital for a renewable energy plant is several percentage points lower than the cost of capital for a coal plant. And the coal plant has a lower lifespan anyway. So you have to borrow at a higher rate and make your money back over a shorter period of time, which will push up the cost of the coal electricity. Ultimately, this is not a political observation. Any sensible executive who is respectful of his shareholders will start to say, “This is what I have to do.”

Climate tech and decarbonization are getting interesting for investors again. Is a bubble like in the 2000s on the horizon?

What does all of this mean for investors?

The best thing to do is to look ahead and actively respond to the changes. Imagine that you’re snowboarding. When you snowboard, you don’t stand with stiff legs and strong knees. What you do is you prepare yourself, you have softer knees, and you keep your core strong, so that you can bounce and ride the moguls. And in the same way, if you’re looking at an investment portfolio, what you can do is put some resilience and flexibility into it.

It's worth noting that venture capital is a highly, highly under-invested asset class.

What’s the best way to do that?

I think it’s worth noting that venture capital is a highly, highly under-invested asset class. Currently it comprises less than 0.5% of all global assets under management, even though it’s been growing very, very significantly. But if you look at the top performing U.S. endowments and foundations, they allocate around 15% of their capital to venture capital. So for any asset allocator, the question to ask themselves is, “What to do the very best foundations know that we don’t know?”

Many people associate venture investments with a high level of risk. Rightly so?

That’s certainly the case if you make direct investments. But if you look at how venture capital funds have performed over the past 25 years, the early-stage venture capital firms returned about a 54% annual Internal Rate of Return, according to Cambridge Associates, whereas the NASDAQ returned 11%. So there’s quite a lot of evidence that you can improve portfolio return by adding venture capital.

LGT has been managing the Princely Strategy for over 20 years. Alternative investments make up an above-average proportion. With this focus, the strategy is one of the few investment concepts for private investors that combines traditional and alternative investments.

What role does venture investing play in bringing progress?

If you believe that we’re in the exponential age, where innovation is a relentless driver of change, the capital that is going to power that process is venture capital. Many of today’s biggest companies were founded on general-purpose technologies of the 1890s – the car, electricity, the telephone. To me, the argument for investors that follows is: “This is the moment where century-long or multi-generational commercial winners emerge.” And they will emerge on top of these radically new, general-purpose technologies. These companies don’t get funded in debt markets or public equity markets but through venture capital. And if you want to participate in this century-long value creation, you’ve got to start early. That means you have to make your allocation to these earliest stage companies.

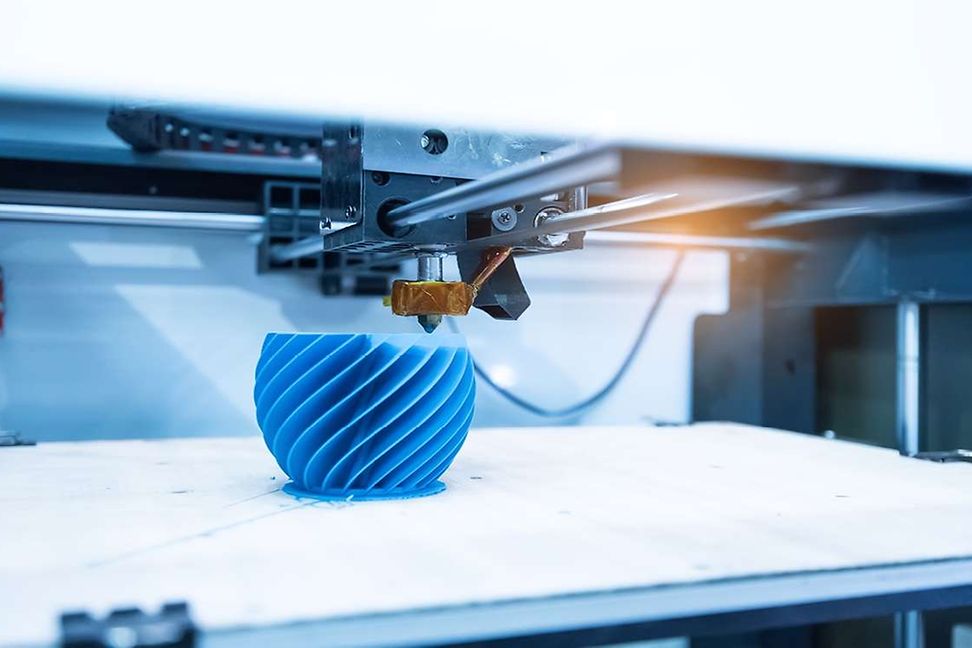

What happens when we have a radically new technology like, say, 3D printing, reach a point where it can really make a difference in the overall economy?

3D printing has been a very niche industry for quite a long time. Currently this form of additive manufacturing is used, for example, in aerospace or medical implants when you need to produce just a few, highly specific products. But again, the curve is really starting to change quickly, the price-performance improvement is about a 30% every year. And at some point, 3D printing may enable the local production of key parts of any finished product.

To what effect?

We’ve already seen a major shift in the last three or four years with the investment in localized production, driven by a lot of questions relating to technological sovereignty and also economic and national security. When it comes to something like 3D printing, what you can imagine it doing is reducing the need to produce finished goods elsewhere, because 3D printers can actually print to a specification. And they can print a replacement part for your vacuum cleaner one morning and something entirely different the next day.

How far will this trend toward local production go?

What I see emerging is a new pattern of globalization. I don’t think it’s the elimination of it, but it has a different pattern, with a heavier emphasis on the local and the regional. Because you don’t get the usual cost savings anymore as living standards are rising in China and other parts of Southeast Asia. At the same time, automation and technologies like 3D printing lower the cost of local production. In addition, technology is becoming strategic. Many countries feel they need to have technological sovereignty. And as a result of the Covid pandemic, supply-chain resilience has emphasized the importance of having full economic security, because economic security means national security.

What does that mean for companies that have spent decades investing in a global economy?

I think the less strategic your products are to a national economy, the more likely you’re going to be able to weather a storm. If your business is in brooms, brushes and doorknobs you may not feel much of an impact. My emphasis is on the more complex, high value products. Because it’s not going to make sense to 3D print a low-cost, low-margin component. But if you need more complex parts, then you need to think quite hard about the diversity of resilience of your supply. You shouldn’t just assume that you will be able to order, say, medical grade LED lights from China, and they’ll appear in two weeks.

Climate tech and decarbonization are getting interesting for investors again. Is a bubble like in the 2000s on the horizon?

Digital transformation shows how destabilizing rapid change can be. What impact will further acceleration have on society?

That’s what technology does: it creates, it unsettles things. But I’m hopeful for democratic societies because I think they will be more responsive. They align better with the market. You get many more signals to process the changes that are going on. The fact that people are increasingly becoming vegetarian, moving to electric vehicles or recycling more. They’re moving to the circular economy. All of that gets signaled back through market decisions, business decisions and of course how voters shift.

Still, many people feel overwhelmed by change and technology they don’t understand.

I think that our relationship with technology really has to change. Because over the past 30 or 40 years we have assumed that technology is something that is produced somewhere over there by people who are not like us. And as buyers we’ve largely accepted that. But embedded in that technology are a lot of implicit value systems, which are not necessarily ours. What I think is possible now is that we can take much more cultural ownership of the digital tools we use every day.

Where does your optimism come from?

Education has shifted and people now better understand technology and how to influence the shape that it takes. And I think that this is a reason to have some measure of optimism, because on the one hand, these technologies are quite magical. They’re getting more powerful, they’re getting cheaper, they’re getting more widely available – and now more of us know how to make use of them and how to fashion them into meeting the needs what we see in our communities.