- Home

-

Private banking

-

LGT career

Thanks to rapid digitalisation and spectacular 4K graphics, gaming is no longer a niche business. In fact, the gaming industry generates more revenue than the music and film businesses combined.

Forget the pasty-faced teen glued to a video game console in the dark. Today's gamers include, well, everyone. Newzoo, a market research company specializing in gaming data, estimates that over 3.5 billion people played a video game last year. Gamer numbers spiked during the pandemic, but interestingly, players didn't desert the pastime when the world opened up again. Numbers continue to grow.

Large global tech businesses have taken note of the video game phenomenon. Gaming developers, long predominantly small entrepreneurs and geeks working in basements, have become increasingly professionalised. According to LGT's Senior Equity Analyst Chris Burger, "You need financial firepower to develop successful games. Today's games need great graphics, great sound, and film-like animation. Perfect execution of these needs teams of hundreds of employees. A small studio simply can't support the process."

Tech giants have long played in the gaming space. Microsoft and Sony are already household names, but the percentage of their overall revenue coming from gaming is rising fast. With the purchase of Activision Blizzard in October 2023, LGT estimates that some 10 per cent of Microsoft's revenue now comes from gaming. Over at Sony, that figure is 32 per cent. Other giants like Nintendo, Tencent, Apple, NetEase, Google, Take-Two Interactive, and Electronic Arts are investing significant sums into gaining market share in the gaming industry.

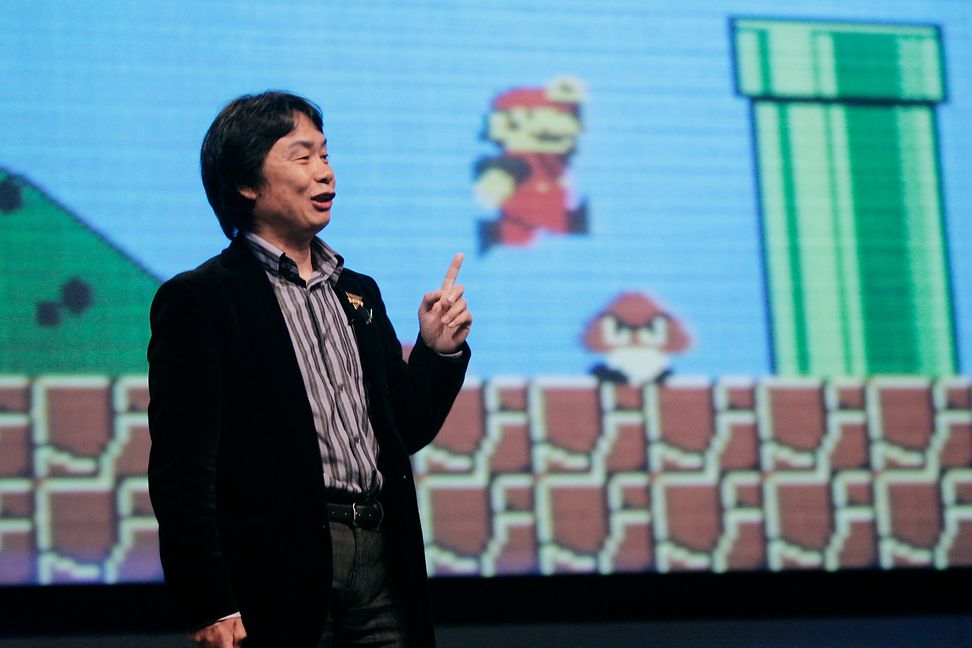

While it's true that gaming is a young industry, it has developed quickly from the Commodore 64 computers of the early 1980s. Nintendo brought out its own gaming console and then the iconic Game Boy, introducing the notion of mobile gaming. Sony entered the market with PlayStation in the 1990s, and Microsoft joined the party with Xbox in 2000.

Until this point gaming was thought of as an activity for children. Now with the introduction of smartphones; high-speed, ubiquitous internet; spectacular graphics; and crucially, more challenging games, adults have become significant gamers. Of course, some of these adults are just child gamers who grew up. But as the stats show, many players only started gaming when it went mainstream. The good news for the industry is that adults have more disposable income than children and have shown a desire to spend plenty on gaming.

Today, games can still be played on consoles and PCs, but mobile gaming is the largest and fastest growing segment of the market. Of the estimated USD 184 billion in 2023 gaming revenue, 49 per cent came from mobile gaming. Consoles accounted for 29 per cent, and PCs for 22 per cent.

The trend towards mobile gaming reflects a larger shift in the industry. Gaming companies have focused on developing ever-more sophisticated games that require ever-more sophisticated and expensive hardware on which to play them. "Now, with the development of cloud computing," explains Burger, "companies are offering games in the cloud that gamers can use on a monthly or hourly basis." The necessary computing power is outsourced from the end device to a server with the appropriate hardware. "This will lead to more platform-independent games in the future and unlock a range of new revenue streams," concludes Burger.

Watching a top-flight gamer is about entertainment

Gaming revenue is split between hardware and software, but Burger expects that in-game purchasing and in-game advertising hold the greatest potential for companies to increase revenue in future. "These micro-transactions represent a lower purchase hurdle for the end customer because of the smaller sums involved," he says. Advertisers are also looking at ways to integrate in-game messaging as a further way to increase revenue.

E-sports is a growing segment of the gaming market, developing particularly fast in Asia. This growth can seem perplexing, but Burger points out that most people watch sport rather than playing themselves. "It's about entertainment. It's about watching someone with a lot of skill. So why wouldn't you want to watch a top-flight gamer?"

"Top players in Asia earn as much as footballers in Europe, and are cheered on by audiences of millions," explains Burger. "At the same time, e-athletes use streaming platforms to drum up publicity for their sponsors: the gaming companies." By establishing a community around a particular game, companies are able to significantly increase engagement, and therefore revenue, for that game.

There's considerable consolidation in the gaming industry, and one reason for this is the significant cost of bringing a blockbuster game to market. Budgets for developing the best video games have exploded over the past decade and now run to hundreds of millions of dollars, with some games taking over five years to develop. For a small company, it can be impossible to bring a range of games to market - and the cost of a flop can be bankruptcy.

One bright light on the horizon is generative AI, which it is hoped will help to mitigate the escalating costs of developing new games. AI has already become a sought-after tool for accelerating content creation.

Where AI could be more than a tool, suggests Burger, is within games. "We see virtual reality as a future stage in gaming development. When you're in the metaverse you are in the game, not just playing the game, and the experience is even richer." It could one day transform role-playing games into infinite, living worlds that can grow organically with the gamer.