- Home

-

Private banking

-

LGT career

The shift to a circular economy promises to reduce waste and lower the world's carbon footprint. Companies involved in the circular economy are not only fighting climate change, they also offer attractive investment opportunities.

Our current consumption habits see us take products made of natural resources like wood, minerals, and water, only to toss them into landfill or incinerators once we've finished with them. Very little is reused. There are endless examples in our everyday lives: from takeout food containers to shampoo bottles, to fast fashion; and to phones and even computers that are upgraded every few years. Many everyday objects are designed for one-time use, or have built-in obsolesce. And most are currently too expensive to recycle at scale.

The waste situation is becoming increasingly dire due to global population trends, growing wealth, and urbanisation. According to the United Nations Environment Program, global municipal solid waste generation will increase to 3.8 billion tonnes each year by 2050, up from 2.1 billion tonnes in 2020.

One crucial way to curb this wasteful use of resources is to shift to a more circular economy that encourages the reuse of products and materials. There are two primary ways to achieve this:

Both avenues present huge growth opportunities for companies in the sustainable packaging and waste management sectors.

It's unavoidable that many items, like food, drinks, and electronics, need to be packaged in paper, plastic, glass, or aluminium to be transported safely from producer to retailer to consumer. Plastic has long been a favourite, but has been losing ground in recent years to cardboard and paper, which are seen as more sustainable and also meet suppliers' CO2 reduction targets.

However, there is no perfect packaging solution. While cardboard packaging has one of the lowest carbon footprints in terms of CO2 per kilo of material, the use of virgin paper fibres can increase deforestation. And when coated with aluminium or plastic, paper and cardboard are difficult to recycle. On the other hand, while the initial production of aluminium has a high CO2 footprint, this is significantly reduced when the metal is recycled. Similarly, the initial production of plastic consumes a lot of energy, but the overall carbon footprint is far lower when recycled plastic is used for new products.

Regulations are being put in place to encourage more recycling. The European Union, which has already enacted a ban on single-use plastics, now wants packaging materials such as plastics, metals, glass, and paper to be collected separately by 2029, making them easier to recycle. The US is also making efforts to increase recycling rates, especially now that waste exports to China are no longer possible. The US has set a federal recycling target of 50% by 2030, lower than the EU's 60% target, but starting from significantly lower recycling rates.

These and other regulatory changes are creating growth opportunities for companies in the packaging market, especially firms focused on carton packaging and aluminium. Both are highly recyclable and likely to replace some plastics in the near future.

Some companies are further ahead than others in creating a closed-loop system. For example, some are already sourcing the majority of their raw materials from recycled fibres while also managing their own sources of raw materials, like forests. And since mixed materials like aluminium and plastic coatings on paper are difficult to recycle, some companies plan to increase the proportion of paper in products, say from 75% to 90% by 2030.

As the world's waste generation increases and natural resources reach their limits, we need to find ways to return waste to the production cycle rather than dump it in landfill (currently the most common method of waste management) or release it uncontrolled into the environment.

Waste management companies are well positioned to grow.

This is the essence of a more circular economy, but it depends on improvements in waste management, especially as increased urbanisation and higher disposable incomes worldwide have meant a sharp increase in products with short lifespans.

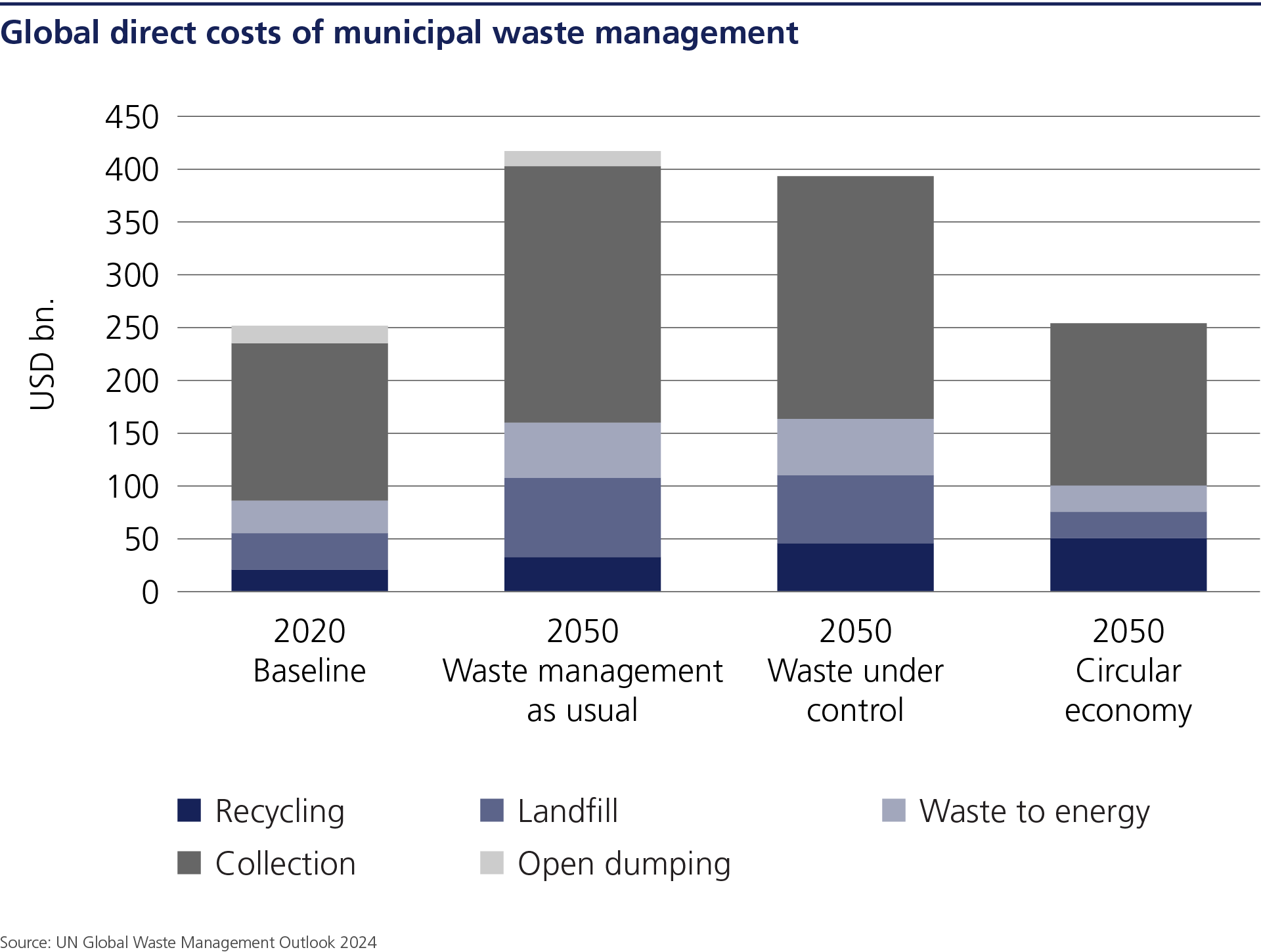

There is tremendous potential for better waste management, especially as it will likely become significantly more expensive in future without improvements. According to the United Nations Environment Program, the global annual cost of municipal waste management was 252 billion USD in 2020. If change fails to happen, it will be 165 billion USD a year higher by 2050. Even if global waste volumes level off, annual costs will still be 142 billion USD higher by 2050. Only a closed-loop model can keep costs close to current levels.

Given the increase in both the volume of waste and the regulatory requirements mandating more recycling, waste management companies are crucial to the development of a circular economy and are clearly well positioned to grow. Indeed, Allied Market Research estimates that the waste management market will grow by an average of 5.5% a year to 3.5 trillion USD by 2032.

Some companies are already building and expanding their recycling capabilities to meet increasing demand. Integrated waste management services can separate and process waste from thousands of households. To deal with plastics, new polymer centres can now sort through the various types of plastics, increasing their recyclability. Some waste management companies are also investing in biogas plants to generate clean energy from organic waste.

Waste management and packaging companies are vital in transitioning to a more circular economy. As consumer awareness rises and regulations tighten, companies that prioritise increased recycling will find new areas for growth, and investors new opportunities to benefit from companies participating in the circular economy.

LGT’s experts analyze global economic and market trends on an ongoing basis. Our research publications on international financial markets, sectors and companies help you make informed investment decisions.

Sustainable investing take into account not only financial aspects, but also so-called ESG criteria - factors relating to the environment, society and good corporate or state governance. The aim of sustainable investments is to generate an attractive return while making a positive contribution to society and the environment. If sustainable investing is important to you, we have a number of options that cater to your needs.