- Home

-

Private banking

-

LGT career

Your portfolio leaves footprints too. How big are they?

Given the current speed of climate change, it is no wonder that companies such as fossil fuel businesses are becoming high-risk investments: They come under increasing levels of scrutiny for their large responsibility for climate change; they face increasing costs to comply with more and more stringent carbon regulations; and they need to fundamentally change their business models.

Far-sighted investors know that the transition to a carbon-neutral and climate-resilient economy is underway. They are convinced that one cannot afford to miss out on this change. In consequence, reducing the carbon exposure of one´s portfolio therefore becomes key in managing climate-related investment risks. This is mainly done through divesting, i.e. choosing to avoid companies that have high carbon intensities and are less likely to do well in the low-carbon economy transition process.

But how do investors know which companies to divest in order to reduce their portfolios' carbon exposure?

Obviously, oil and gas companies as well as firms heavily exposed to coal are extremely unattractive due to their high carbon exposure. But to answer this question accurately, the carbon intensity of investments needs to be comparably calculated. How is this done?

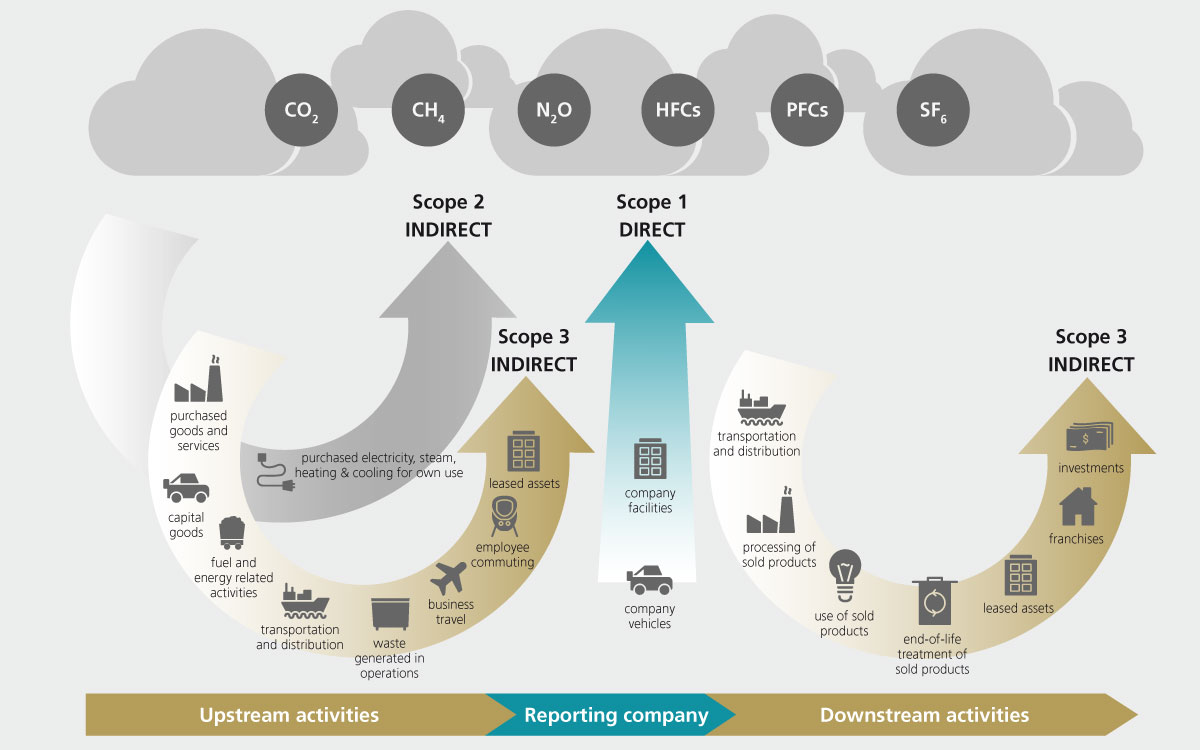

The basis of the calculation of a portfolio's - or any investment's - carbon intensity is the carbon emission of every invested company. This is done by measuring or estimating the quantities of various greenhouse gas emissions that can be directly or indirectly attributed to the activities of a company.

All emissions from a company's direct operations (scope 1) as well as its energy and heat consumption (scope 2) are measured in metric tons of carbon dioxide equivalent (t CO2e).

For example, a chemical company records direct CO2 emissions (scope 1) from production as well as power and steam generation from its own plants, and indirect CO2 emissions (scope 2) from the production of electricity it purchases from suppliers. All the other indirect CO2 emissions (scope 3) produced along the value chain - such as transport, use or disposal of products - are not factored in the carbon intensity calculation, as scope 3 emission data is difficult to collect and estimate accurately. Moreover, a company has little influence on its scope 3 carbon emission reduction. For example, a car manufacturer cannot decide how its cars are used and its consequent scope 3 emission levels.

Based on scope 1 and 2 emission data, there are mainly two approaches to calculate a portfolio's carbon intensity: One is the carbon footprint. This is the total carbon emissions for a portfolio normalized by the market value of the portfolio, measured in tons CO2e/USD million invested. The other is the weighted average carbon intensity. This indicates a portfolio’s exposure to carbon-intensive companies, measured in tons CO2e/USD million sales.

For the carbon footprint approach, the value of a company's shares held by a portfolio is set in relation to the company's enterprise value. This ratio is multiplied with the carbon emission of the company, resulting in the emissions that the investor "owns". A portfolio's carbon footprint is assessed by aggregating the information on a portfolio level normalized by the market value of the portfolio. This approach allows for direct association and quantification of the portfolio emissions. It also enables investors to compare the carbon intensity of one portfolio with another.

The weighted average carbon intensity approach allows for carbon emission comparison between companies of different sizes in one portfolio by showing how many tons of CO2 emissions a company generates per million US dollars in sales. Emissions are allocated based on portfolio weights, i.e. the value of investment relative to portfolio value. The respective weight is then multiplied with the carbon emissions of the invested company normalized by sales. The result provides insights into if a portfolio invests more into carbon intensive companies compared to other portfolios or to a benchmark. Portfolios with higher carbon intensity exposure are likely to face more carbon-related market and regulatory risks.

Measuring the carbon intensity of portfolios enhances transparency of climate-related risks. Both approaches described above provide investors with important insights to ensure that their investment decisions really do have an impact on CO2 emissions. This holds true especially when compared to the carbon budget available to reach the two-degree target of the Paris Agreement that wants to keep this century's global temperature rise well below two degrees Celsius above pre-industrial levels.

Measuring is the first yet fundamental step towards unleashing investors' power on climate change mitigation and adaptation.

In order to combat climate change and support climate friendly investment decisions, LGT Private Banking provides full transparency of portfolio carbon footprint in their clients’ statement of assets. Also, efforts in climate actions has become a criterion in choosing external asset managers at LGT Capital Partners. LGT Venture Philanthropy invests in organizations and companies which directly contribute to UN Sustainable Development Goal No. 13 – Climate Action.