- Home

-

Private banking

-

LGT career

After securing their parties' nominations, Joe Biden and Donald Trump are set to go head to head again in this year's presidential elections. But the US currently stands at an important crossroads, and that won't change, no matter who wins.

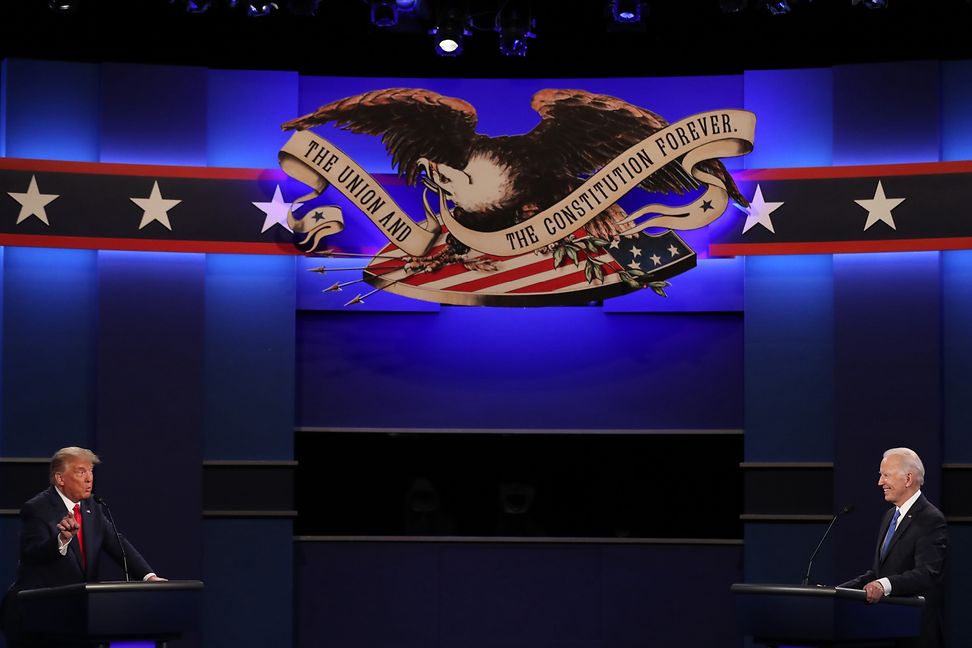

The highly anticipated US presidential elections are scheduled for 5 November 2024. It is now clear that the election will be a rematch between Joe Biden and Donald Trump. Voters are clearly split along party lines. And this strong polarisation is being further fuelled by deep-rooted fears about the nation's future - which is mainly due to the former president's track record of not playing by the rules and not respecting government institutions. Suffice it to say that the stage has been set for an exciting showdown this autumn.

The 13 swing states, which are traditionally hotly contested because both parties enjoy a similar amount of support there, will be key in determining the outcome of the election. Voter sentiment in these states will depend to a great extent on how the parties respond to the big issues. Economic concerns are at the top of many voters' lists, especially the cost of living, which, like in Europe, has risen sharply during President Biden's term in office. The ballooning federal deficit is another big topic.

The winner will inherit a nation at a crossroads.

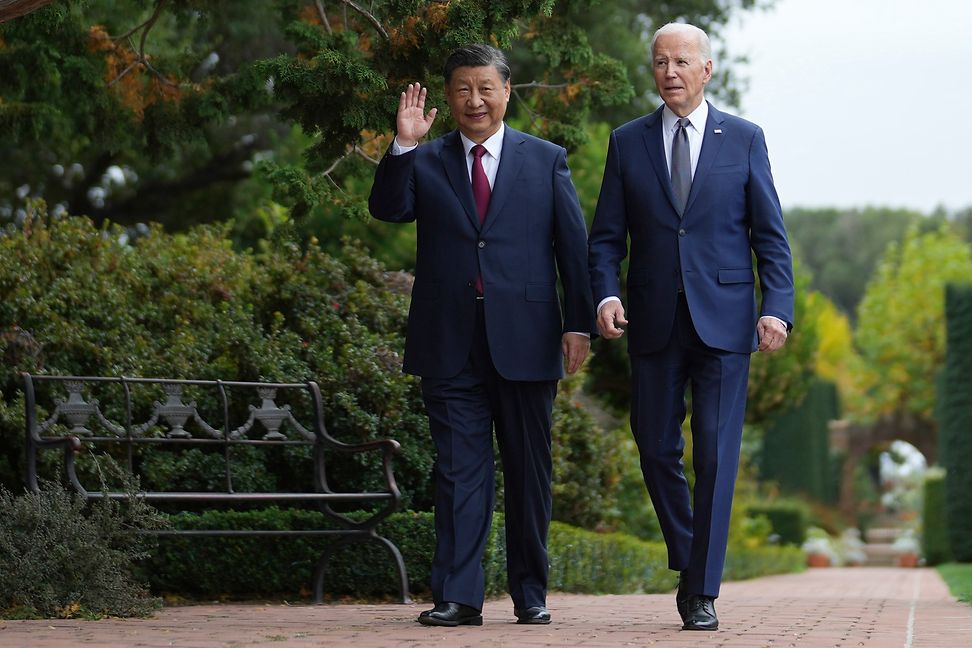

Immigration policy is also likely to be a focal point, especially after the painstakingly negotiated bill coupling increased border protection with military aid to Ukraine was rejected by the Republicans. Other points of contention include foreign policy and trade - so relations with China, the war in Ukraine and the US's relationship with NATO - and major social issues such as abortion rights and gun ownership. Not surprisingly, the views of the Democrats and the Republicans and how they plan to resolve many if not all of these isues, are hugely divergent.

Investors, on the other hand, are most interested in the different ways that Joe Biden and Donald Trump plan to address the big economic issues. They want to know what's next in terms of fiscal policy, what the candidates plan to do about the national debt and whether or not they want to introduce tax reforms. These are all important issues, ones that the Democrats and the Republicans take fundamentally different approaches to.

For example, both parties are expected to want to reduce the deficit. Under a Biden administration, the Democrats would likely try to curb the deficit by increasing taxes for corporations and the wealthy. Also, the Democrats would probably let Trump's 2017 tax cuts expire in 2025 and once they do, increase spending, especially for social programmes.

A Republican administration under Trump would have different priorities. These would likely include continuing the deregulatory agenda pursued by Trump during his first term, and upholding the lower tax rates introduced at the time. The Republicans would probably also focus on other areas of fiscal policy, and, for example, strive to reduce government debt by cutting certain spending programmes rather than raising taxes.

The two candidates would probably also pursue very different paths when it comes to trade. A Trump administration would most likely consider introducing new trade barriers, especially for BRIC countries. Then there's the US's future relations with China - an issue that is sure to also get strong international attention. Although no major shifts are expected in this area no matter who comes to power, it's quite possible that the next administration will further restrict Chinese imports and US investment in China.

It's clear that there will be more at stake on 5 November 2024 than just a battle for political supremacy. Whoever wins will inherit a nation at a crossroads, and will have to address critical fiscal and societal issues that will shape the future of the US.

The upcoming presidential elections promise to be a defining moment in American politics, with far-reaching implications for the future political direction of the US and its role on the global stage.