- Home

-

Private banking

-

LGT career

Artificial intelligence makes it increasingly hard to filter information when making investment decisions. This could lead to disastrous consequences. Fortunately, there are ways to counter the AI challenge and ensure safe outcomes.

Investment decisions can be difficult, even when you have reliable data at your fingertips. But with the rapid advance of artificial intelligence (AI), which creates ever more distracting noise and misinformation, it's easy to feel lost in a sea of potentially misleading content.

AI can support your financial choices by easing and tailoring access to information. But it can also introduce many potential distortions, including biased data and false "facts". Even worse, AI-generated content can easily be designed not to give you a balanced view of the truth, but to exploit cognitive errors like confirmation-, recency-, and framing biases.

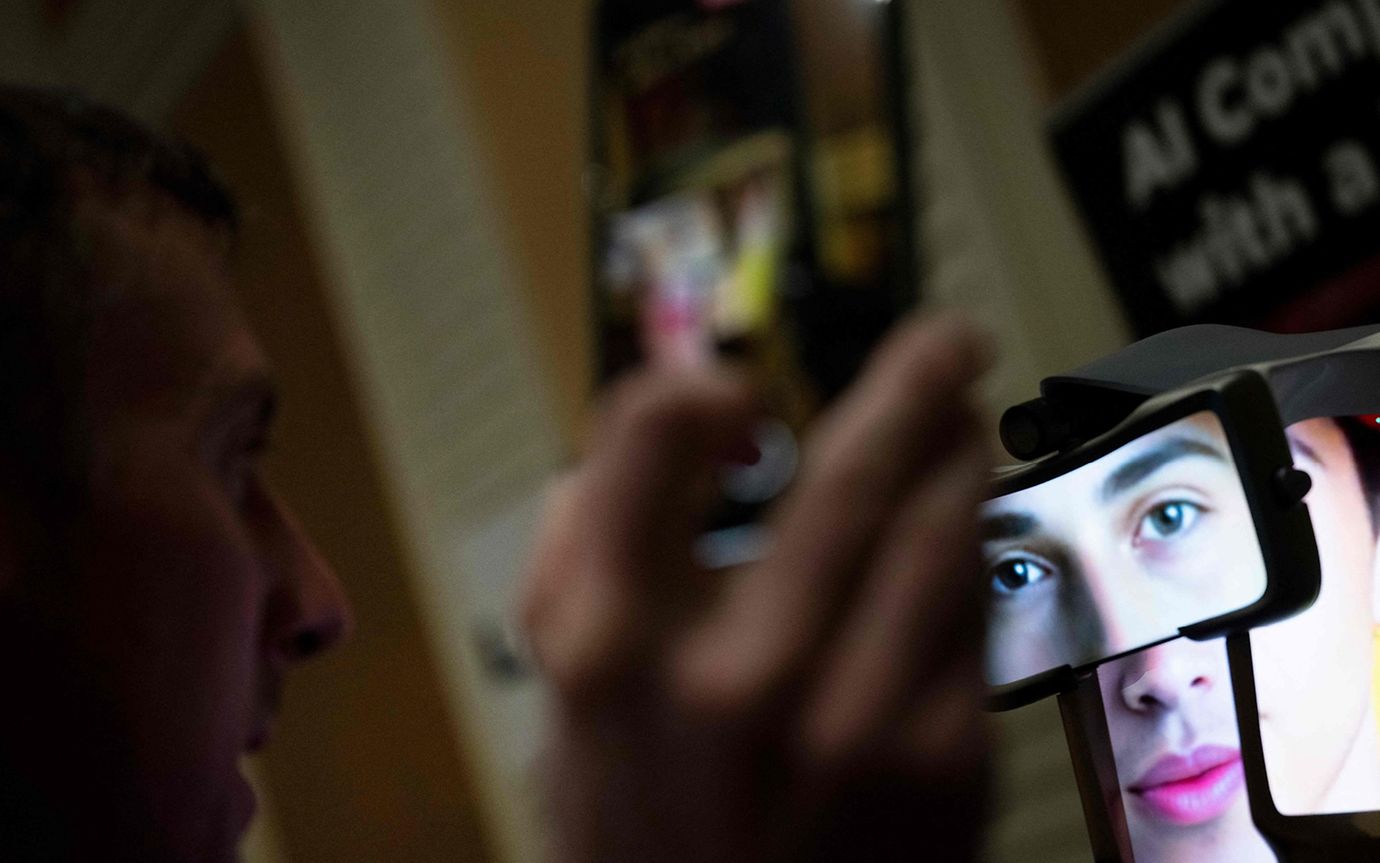

Plus, it makes fraud much easier, for example by using deep-fake images and videos. Deep fakes increased by over 3,000 per cent in 2023 according to ID verification provider Onfido, and some of the most pernicious have exploited public trust in financial experts.

The overall result is a wave of AI-fuelled "post truth" misinformation that can significantly distort your investment decisions and lead to negative or even disastrous results. Still, there are ways to navigate these challenges and find reliable information to support solid investment plans and positive outcomes.

Not long ago, we were used to accessing news and data from reasonably balanced and reliable sources, such as the Wall Street Journal, Financial Times and Economist. But now we are also exposed to a barrage of information, of varying reliability, from wider sources such as YouTube, social media, and "clickbait" news stories.

Alex Edmans is Professor of Finance at the London Business School and author of "May Contain Lies: How Stories, Statistics, and Studies Exploit Our Biases". He says that the growing spread of information means that much more is published by authors whose goal is not to share scientific research, but marketing. These writers' claims that there are all sorts of factors that can impact investment returns are designed to entice you onto their pages, purely so they can sell you services or feed you advertising.

This content often grabs our attention by exploiting simple fear or greed. And confirmation bias means we accept it uncritically if it confirms what we want to be true, even if the supporting evidence is flimsy.

An example is people buying electric vehicle stocks in the early 2020s because of viral posts based on flimsy evidence. Investors piled into EVs regardless of their price and whether they were a wise investment at the time.

Simon Gomez, Head of Data and Innovation at LGT Private Banking, says: "Generative AI has reduced the cost of producing content to almost nothing. This leads to ever more information that can drag investors in the wrong direction. Cutting through this noise is an increasing challenge."

Content generators want you to click as many pages as possible, so they use AI to add more and more posts, with little regard for evidence or truth. Our brains are constantly at risk of falling into those attention traps.

Challenge your ideas and filter relevant information to avoid drowning in the noise

For example, doom-mongering "experts" now constantly post warnings that the stock market is about crash - knowing they will eventually be right. This naturally triggers fear in investors, so is an easy way to generate clicks and advertising revenue. But it could persuade investors to exit the market and miss out on significant potential long-term growth.

Gomez says: "Long-term investors need to stay invested - not duck in and out of markets. But it's easy to get scared, exit too early, and miss a rally. For example, following the financial crisis in 2008, many people were not properly invested in the market for a long time afterwards because they were still scared."

The same thing happened after the pandemic. "Finding out whether you're wrong or not is the only way to find out what's right," says Edmans.

"A trusted adviser can also challenge your ideas and filter relevant information to help you avoid drowning in all the noise," says Gomez. "You could of course delegate your entire investment process to the experts. But if you want some involvement, use your adviser as a trusted sparring partner, testing your ideas along the way, and helping you keep your plan on track."

LGT’s investment tools are becoming ever more sophisticated, and we see a lot of potential in using AI to filter relevant content from market noise and avoid misinformation. These tools can help our investment analysts to make better decisions, and our advisers to improve their service to clients. It is crucial that these tools are backed by strong governance structures and ethical processes to ensure the results are trustworthy and bias-free.

Artificial intelligence is not going away. The noise it produces will only get louder and more confusing. Using a professional adviser to help you cut through the din and guide your investment decisions will be critical - and is also an excellent way to use AI to your advantage.

Do you follow international financial markets and prefer to make quick, well-informed investment decisions yourself? We can proactively provide you with ideas and proposals from the wide-ranging experience and expertise of our investment specialists and advisors, but you make the final portfolio decisions. We monitor and report to you regularly, allowing you to actively manage your portfolio in line with your investment philosophy.