For Benjamin Franklin, life’s only two certainties were death and taxes. If you are choosing to pay for a private education for your child, you could add school fees to that list.

A private school education has been described by some as one of the most important investments a parent can make for their child. The benefits are clear - the teaching, the facilities, the breadth of opportunities on offer - but the fees are a major consideration for most families; a large, lengthy financial commitment which requires careful planning.

The good news is that this is, to some extent, a buyer’s market, and there is definitely scope for negotiation with schools when it comes to fees. Read on for an overview of school fee costs, highlights from Talk Education’s interview with Head of Wealth Planning, Simon Allister, on how to save for your child’s education, and how Talk Education can help compare schools’ fees.

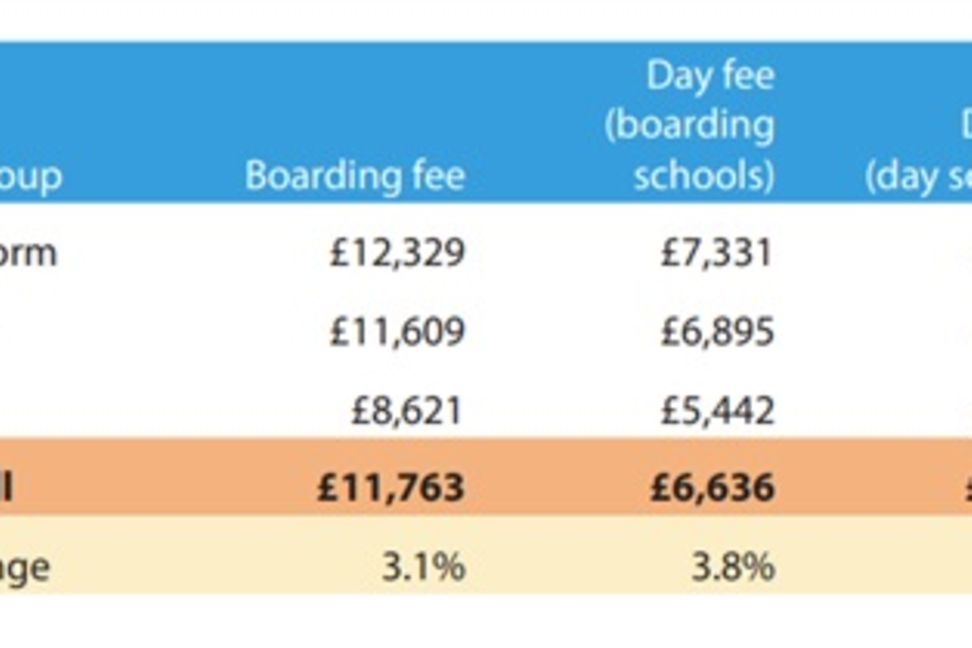

The Independent School Council’s (ISC) census from 2020 shows that the average termly fee for a day school was £4,980; for boarding schools, this termly average was £11,763.

Source: ISC Census 2020

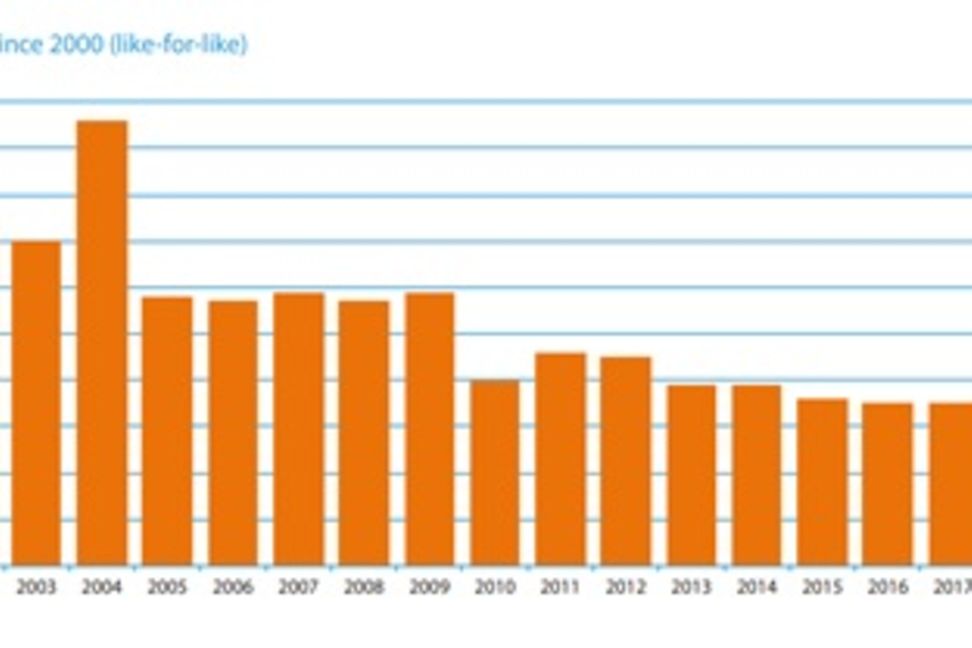

The ISC’s Census also examined trends in school fee increases, showing how volatile these increases can be:

Source: ISC Census 2020

Schools are under pressure to keep fees as low as possible, whilst also having to keep up with the ‘education arms race’ – to build newer, shinier facilities, keep pace with their competitors and meet parental expectations. The increased costs of the Teachers’ Pension Scheme and the additional cost implications of the COVID-19 pandemic also have to be taken into account.

The financial commitment of private school can feel daunting, but understanding your current financial situation is a good place to start. Making the effort to appraise your income and expenditure will not only help you understand the affordability of private education, but it will help you feel more in control and could bring out other areas of planning that you may need to address. Saving early – even before your child is born – is also something to consider, helping to spread the financial burden over a longer period of time.

Watch Talk Education’s video interview with Simon Allister, our Head of Wealth Planning, here. Simon talks through the key points to keep in mind when contemplating school fees:

Fees vary from school to school, so it is vital to do your research, make comparisons and understand exactly what is included and what is not. Talk Education is a dynamic digital schools guide and parent advisory service.

Talk Education has designed their school pages to give you a clear picture of each school, with an editorial review and the latest data on everything from the subjects offered at A Level to academic results and leavers’ destinations. In the Fees and Bursaries section on each school’s page, you will find the termly fees for each year group, and detailed information on that school’s bursary programme. You can save your favourite schools to your parent dashboard and compare data - including fee information - across a range of schools. More information is available on their school fees focus and financial aid pages. If you have more questions or need bespoke advice for your family, Talk Education’s parent advisory team will be able to help.

Contact details : www.talkeducation.com | talk@talkeducation.com

Follow Talk Education on: Twitter | Facebook | Instagram | LinkedIn

Read more from The Brief.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.