Companies are taking advantage of discounted bond prices to buy back debt at a reduced cost, effectively allowing them to pay less while reducing their debt by the full par value.

British American Tobacco's recent tender offer highlights this strategy, offering a premium to bondholders while significantly reducing the company's outstanding borrowings.

With central banks maintaining high interest rates, more companies are expected to pursue similar debt reduction opportunities over the next 12 to 18 months, enhancing their credit metrics and financial stability.

We recently discussed how companies facing looming maturity walls – when a substantial amount of a company’s debt is set to mature within a short period – responded by offering to buy back – or tender – their bonds. This helps reduce the maturity walls and lowers their immediate refinancing needs.

This week, we outline another opportunity presenting itself for both companies and investors which allows companies to reduce overall debt and improve credit metrics by buying back bonds trading at low cash prices.

When interest rates were low, companies issued long-dated bonds with low coupons (or rates) of around 3% or below. This offered an attractive opportunity for companies to secure cheap borrowing costs and for investors to lock in stable income streams. However, when central banks began raising interest rates to combat inflation, these low interest bonds became less attractive, since investors could receive higher returns from other securities, including newly issued corporate and government bonds. As a result, the prices of the low-interest bonds dropped to balance the difference.

Bonds are eventually redeemed at 100% of their full value - called par - and their prices fluctuate depending on market interest rates. An investor buying a low-interest bond in a high-interest rate environment will receive a lower income throughout the holding period but benefits from the bond's price gradually rising to its full value by redemption.

To compensate for the loss in income, some long-dated bonds are trading at discounts of 50% or higher to their full par values. However, under accounting rules, when a company issues a bond, it records the full outstanding amount of the bond as debt on their balance sheet. This value remains broadly stable until maturity, as it does not change based on market prices.

A company can reduce its debt by buying back these bonds at a discount. This means they pay less than the bond's full value but still reduce their debt by the full amount. It's like "buy one, get one free," paying 50 cents to eliminate $1 of debt.

Reducing debt can improve a company’s credit ratings and lower interest costs on future issuance. Tender offers tend to present attractive opportunities for bondholders too as companies generally pay a sizeable premium to the prevailing market value of the security.

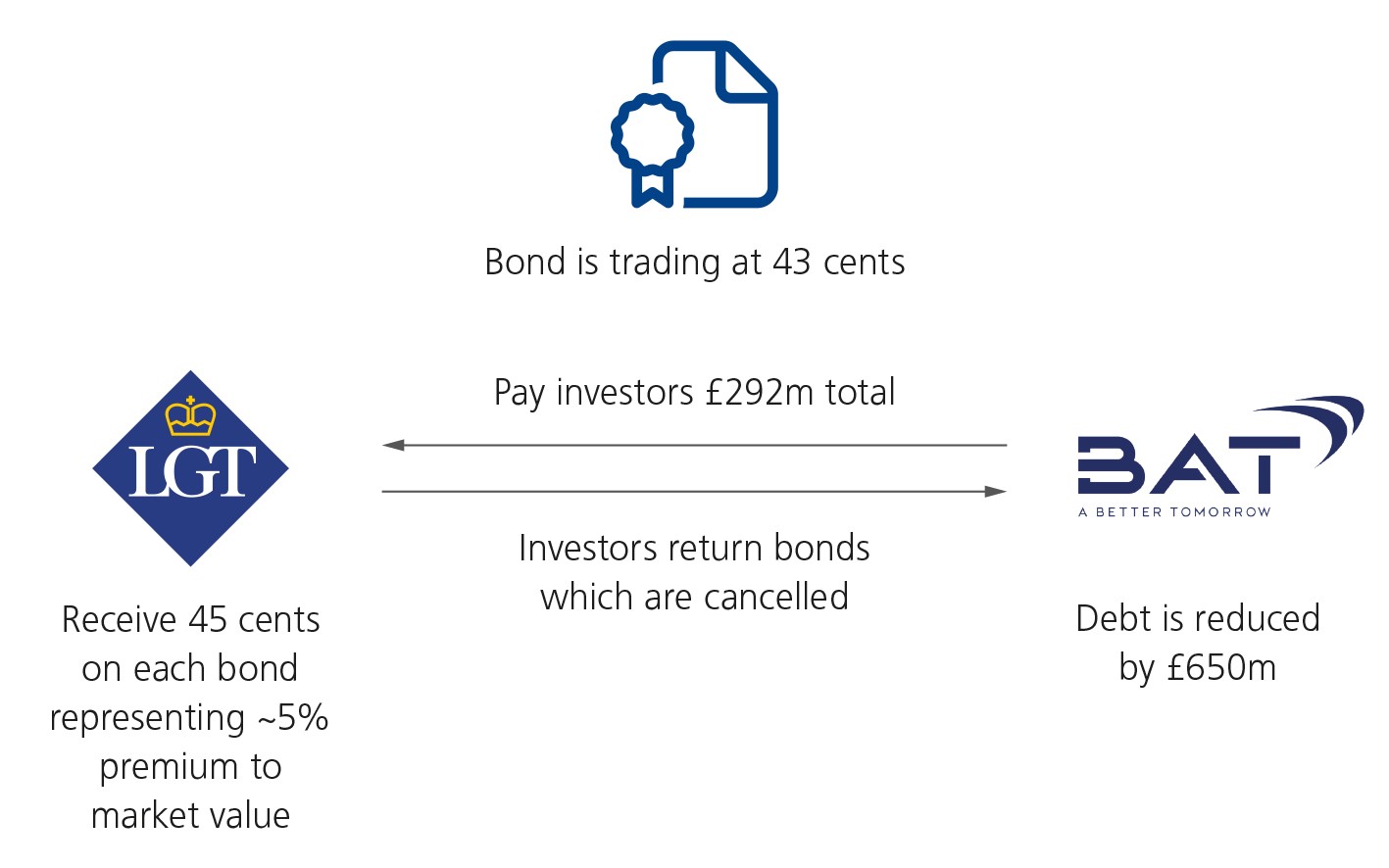

A recent example is British American Tobacco's (BAT) £1 billion offer to buy back its long-term bonds, focusing mainly on the 2.25% bond due in 2052.

This bond, issued in September 2016, accounted for £650 million of the company’s outstanding debt. Due to its low coupon of 2.25% and long maturity date of September 2052, the bond’s price steadily declined to around 40 cents on the dollar by September 2022. The price has remained around that level and it was most recently trading just below 43 cents prior to the tender.

BAT offered to repurchase this bond from investors at a price of 45 cents, a 5% premium to the market price, an attractive opportunity for investors. To take the entire bond off the market, BAT would have paid investors around £292 million. However, given the full amount outstanding under this security was £650 million, the company would have been able to reduce borrowings on its balance sheet by the full £650 million. As a result, this tender is a win-win both for the company and the investors.

BAT is rated investment grade by the major credit rating agencies. Maintaining this status and reducing debt is one of management’s highest priorities. BAT generates excess cash flow of approximately £8 billion annually and can allocate some towards repurchasing debt.

BAT has been reducing its debt through short-term tenders and is now targeting longer-dated bonds like the 2052 issue for quick and efficient debt reduction.

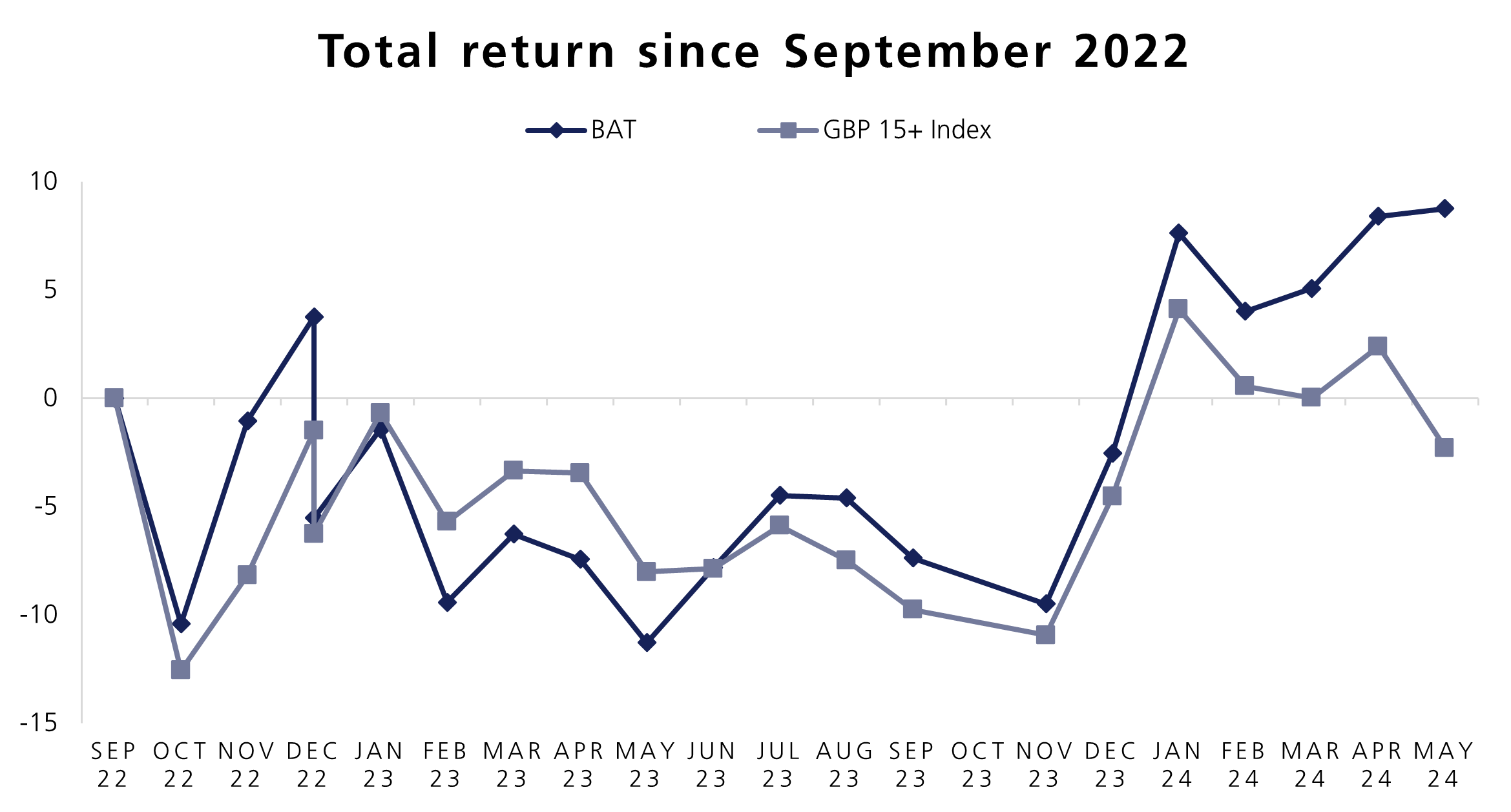

Since Liz Truss’s mini-budget crisis in September 2022, this bond has returned 8.8% including interest, compared to losses of -2.3% for the Sterling Corporate 15+ index.

With central banks maintaining interest rates ‘higher for longer’, many long-term bonds are priced low, offering attractive opportunities for companies and investors. Interest rates remain high for now but are expected to come down eventually, resulting in price appreciation for these securities. Meanwhile, companies continue to operate at high margins and generate record amounts of excess cashflow as the economy remains robust. We therefore expect corporates to continue looking out for opportunities to reduce their debt efficiently via tenders over the next 12-to-18 months.

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.