Historically, September is the worst month for stock markets. Given the limited trading activity and low liquidity during the summer, many investors return from their holidays and reassess economic momentum before making portfolio changes. This can weigh on equity performance in September. The S&P 500 and Nasdaq have posted negative returns in the last four consecutive Septembers.1

In addition to normal seasonality, several other factors will likely influence markets this September. A contentious election in the US and mounting concerns of a cooling US economy both contributed to a volatile start to the month that saw the S&P 500 fall 2.1% in a single day on 3rd September, its worst daily performance since the global turmoil on 5th August.2 It also marked the largest market cap drop in history for a single stock – Nvidia lost nearly $280 billion in market cap in a single day.3 Oil prices fell from around $80 a barrel at the end of August to $70 and the volatility index, the VIX, rose by 33%.4

This recent volatility is similar to what we saw in August. The sell-off and subsequent unwinding was not only driven by the Japanese yen carry trade – when investors borrow money in a currency with low interest rates and use it to buy stocks and bonds in currencies with higher interest rates – but also increasing concerns over the state of the US economy.

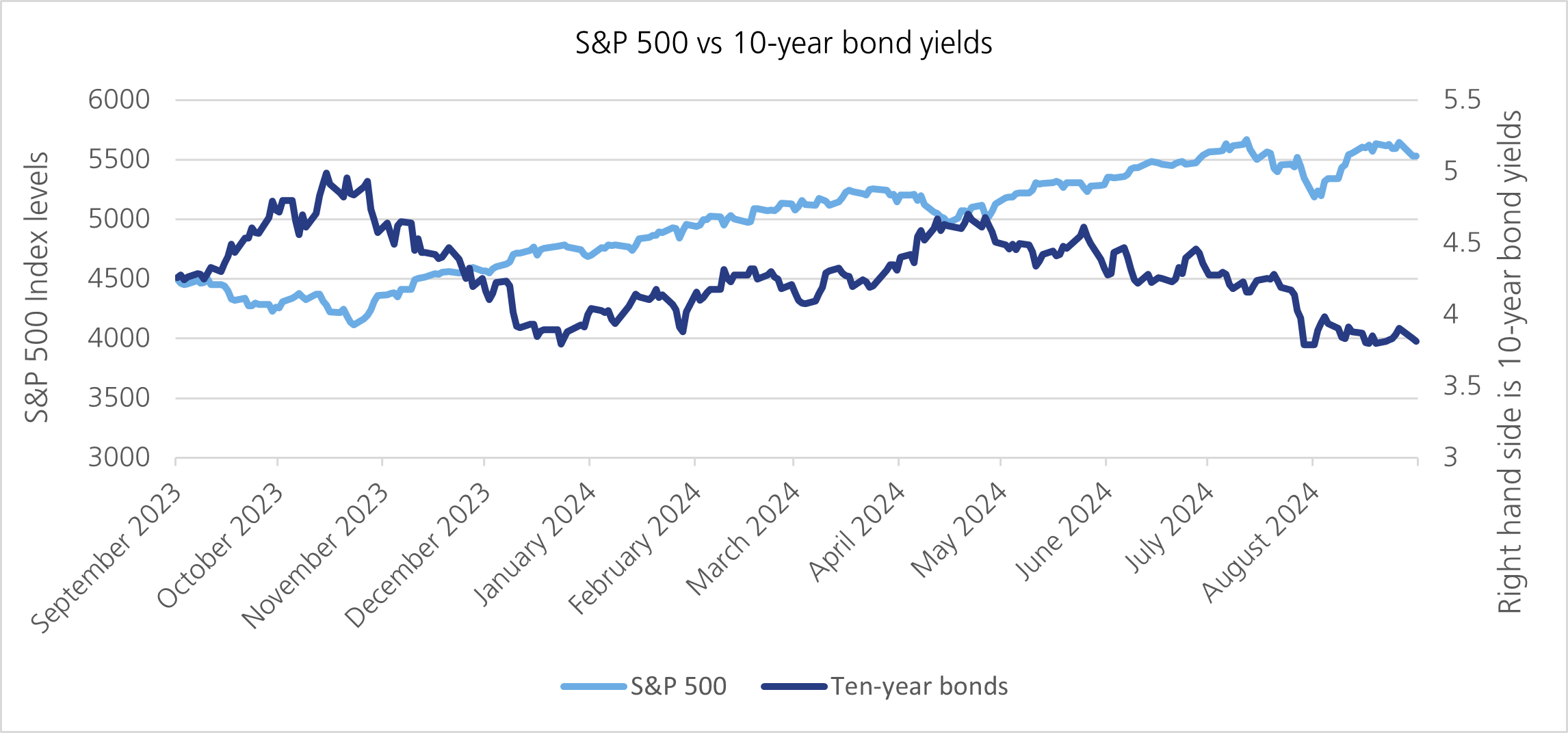

This September is different for several reasons. September’s decline in 2023 was driven by sharp bond market selloffs as strong economic data made investors reassess whether US interest rates had peaked, or whether the Federal Reserve (Fed) would need to raise them further.

This time, bond markets have outperformed while equities have declined. This negative correlation between bonds and equities – the cornerstone of the 60/40 portfolio — seems to have reasserted itself as concerns are no longer driven by inflation but a weakening labour market and its potential to weigh on US growth.

What we are witnessing in equity and bond markets makes sense. Growth concerns typically result in rates being cut to stimulate the economy, while inflation concerns keep rates elevated and could potentially drive rates even higher.

There are several other factors that could make this September particularly volatile. This week’s jobs report will provide guidance about the frequency of future Fed rate cuts and will be closely monitored by investors. Stock market concentration in a few very large technology companies make it susceptible to significant moves.

That said, it is true that sometimes that too much emphasis is placed on seasonality and the importance of deriving investment implications from it. Ultimately, it is important to have a diverse mix of assets that protect investor capital in more challenging environments, as well as growth assets when economies grow. Getting this balance right can be challenging and it is something our Investment Committee discusses frequently. We often tilt our positioning to ensure clients capture returns without suffering undue volatility.

[1] Bloomberg

[2] Deutsche Bank, Bloomberg

[3] Deutsche Bank, Bloomberg

[4] Bloomberg

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.