President Donald Trump was inaugurated in January and set out to swiftly implement his agenda. He has kept most of his campaign promises, slapping tariffs on long-standing trading partners, imposing sweeping cuts across the US government and pulling back support from America’s long-time global allies. This led to a sharp reversal for US equities over the quarter.

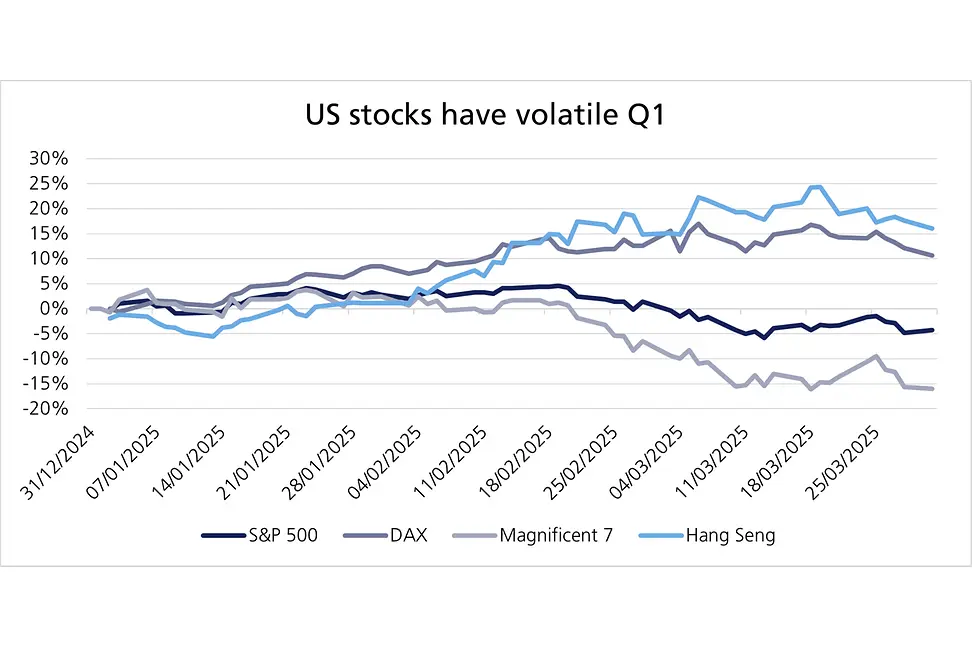

The S&P 500 fell 4.3% in the first quarter, while the small-cap Russell 2000 Index dropped 9.5% as the initial euphoria around expected deregulation and tax cuts faded. Conversely, European and Asian markets demonstrated resilience, as European indices benefited from increased government spending, while Chinese technology stocks rebounded on advancements in artificial intelligence (AI).

Long-standing European allies were stunned as Trump’s desire to end the war in Ukraine put pressure on Ukrainian President Volodymyr Zelensky while offering concessions to Russia. This spurred the continent into action as they agreed to boost defence spending. After its election, Germany’s coalition announced a new fiscal regime, a remarkable reversal for a country known for its cautious spending. Some believe it could prove to be the spark to reignite long-term growth in Europe. Meanwhile, central banks continued to diverge in their interest rate cutting policies as widely predicted, with tariffs and stagflationary data complicating their future paths. US government bonds performed well over the quarter as investors embraced risk-off assets while German government debt fell sharply given its fiscal plans.

It was a tough quarter for US equities, with the aggressive threat of tariffs and sell off in market leading technology stocks roiling markets. The widespread tariff announcements began in late January after the Trump administration’s arrival in Washington, when they announced 25% tariffs would be placed on Canada and Mexico. Investors relaxed somewhat when these tariffs were delayed, resulting in the S&P 500 hitting new highs in mid-February. However, tariff uncertainty picked up again when the extension for Canada and Mexico ended and Chinese tariffs were raised from 10% to 20% on 4 March. On 12 March, tariffs on steel and aluminium were imposed at 25%. All told, tariff turbulence sent the S&P 500 down 4.3% in the quarter, while the Nasdaq Index dropped 10%.

Furthermore, in January, Chinese start-up DeepSeek released a new AI model rumoured to be as good as US AI models and cheaper. This led to questions around US technology companies’ valuations, wiping billions off Magnificent 7 companies’ value. The Magnificent 7 companies fell 16% in the first three months of the year, reversing post-election gains.

While US equities struggled, European markets posted solid performance. Economists upgraded growth forecasts for the region as Germany led the way in rewriting the continent’s historic fiscal regime rule book, with a marked shift towards higher defence and infrastructure spending. The first quarter witnessed the biggest quarterly performance gap between the Stoxx Euro 600 Index and the S&P 500 in a decade.1 Germany’s fiscal package, announced after the new coalition was formed, helped send the DAX Index up 11.3% over the period, while France’s CAC Index rose 6%. The increased spend from Europe along with improving fundamentals and cheap valuations not only proved to be a powerful catalyst for European equities, but also benefited the euro, which saw a 4.5% rise versus the dollar.

UK equities had a solid quarter, gaining 6.1%. However, the outlook for the UK remains challenging, with inflation continuing to prove sticky and weak business and consumer sentiment following the first Labour budget. The Office for Budget Responsibility (OBR) adjusted their 2025 growth forecasts down to 1% from 2%. With this backdrop, Chancellor Rachel Reeves delivered her Spring Statement, which included welfare cuts, departmental savings and increased defence spending.

Asian equities meanwhile were buoyed over enthusiasm surrounding DeepSeek, underscoring the valuation differences across global technological firms as China and India ramp up their AI capabilities. The more technology-focused Hang Seng Index rose 16.1% in the quarter, but Shanghai Composite fell 0.2%, as tariff concerns weighed on the market. Meanwhile in Japan, the Nikkei dropped 9.9%, partly due to the strengthening yen.

The divergence among central banks’ interest rate cutting regime picked up steam in the first quarter. The Federal Reserve (Fed) held interest rates steady at their first two meetings of the year, with Chairman Jerome Powell highlighting the uncertain outlook. Powell acknowledged concerns about tariffs, but said he expects tariff-driven inflation will likely be “transitory”. His comments helped lift stocks but the outlook remains murky given the uncertainty.

The Bank of England (BoE) meanwhile lowered rates in February but held them steady in March, as the UK faces a lack of clarity over global trade and inflation. The European Central Bank (ECB) began the year by lowering interest rates, in line with market expectations, which had forecasted the ECB would cut interest rates at every meeting until June. But the ECB’s future path is less certain, with US trade policies and fiscal stimulus complicating the central bank’s future decisions. Some ECB members have said it should consider holding rates steady as tariffs could push inflation higher and dampen economic growth. The Bank of Japan (BoJ), which is embarking on a rate-hiking cycle, delivered another hike in January, bringing interest rates to 0.50%. The BoJ signalled more hikes are ahead given elevated wage pressures.

The first quarter of 2025 was marked by heightened geopolitical tensions, volatile markets and a shifting global landscape. Trump’s sweeping tariffs have escalated the threat of trade wars, which have raised fears of inflation and a global slowdown. Central banks globally face tough decisions as they balance inflation risks with economic growth concerns. We are hopeful that the recently announced trade tariffs are a tool to get countries to the negotiating table.

On the bright side, the shift in sentiment we have seen in Europe is remarkable. European stocks have been out of favour with investors for a long time and the shifting fiscal policy combined with fading US dominance have driven a reappraisal of the region.

Volatility and uncertainty will likely continue. As always, we will monitor the geopolitical risks and evaluate how they affect asset classes and our underlying companies. Ultimately, we look for companies that are well positioned to withstand political turbulence and compound earnings over time.

[1] Deutsche Bank, Bloomberg

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.