Prime Minister Rishi Sunak’s decision to bring forward a general election to 4 July took many by surprise. Most expected the Conservatives to hold out as long as possible before calling a general election, hoping that moderating inflation and the start of the Bank of England (BoE)’s interest rate cutting cycle would help their chances at the polls.

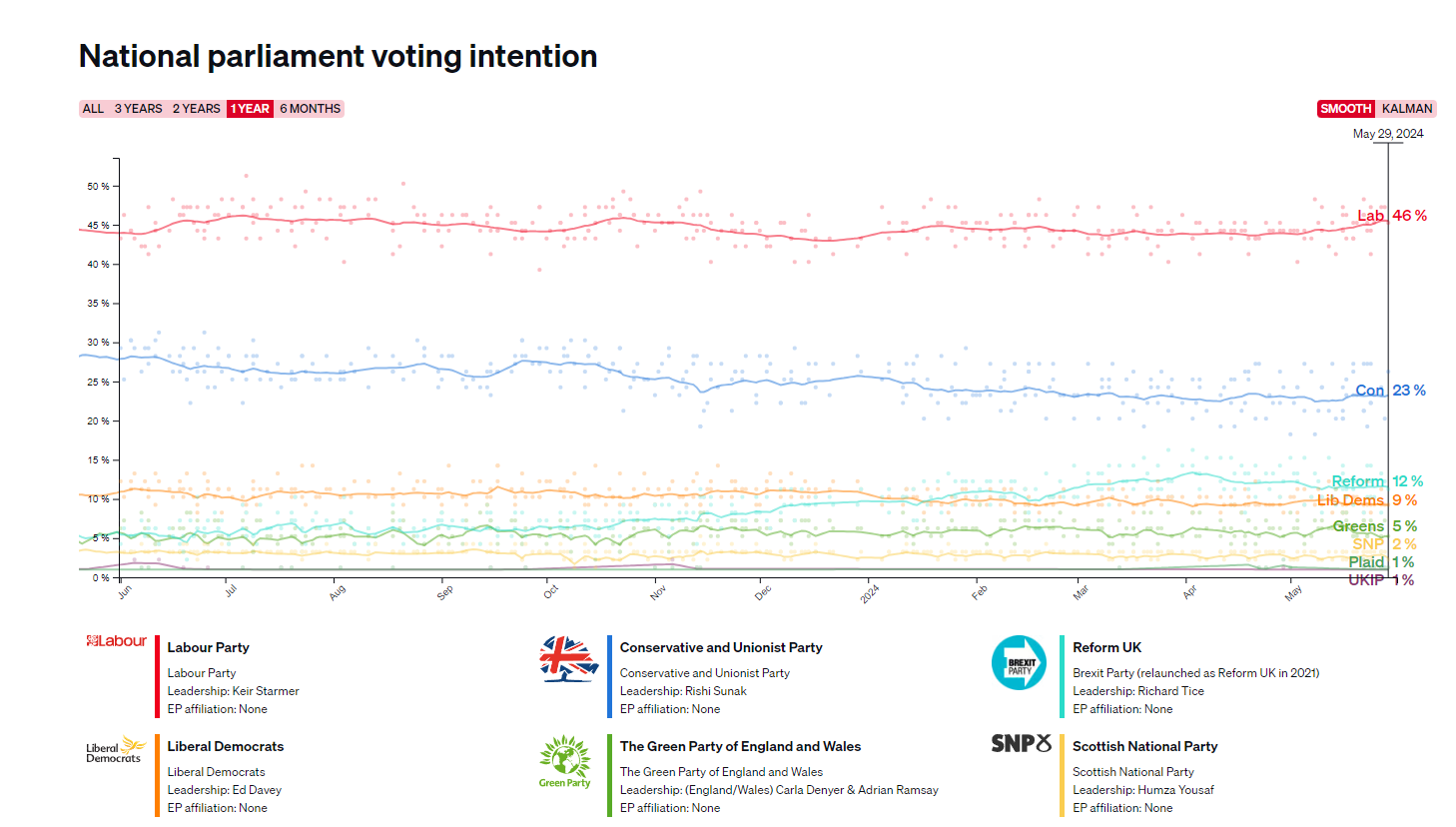

There has been limited market reaction to the news so far, with the UK gilt market showing little movement in the days following Sunak’s announcement. The polls have shown for months that Labour are on track to defeat the Conservatives, so markets and companies have priced in a Labour government.

However, the size of Labour’s majority will matter, and we feel a smaller majority would be more challenging. If Labour wins fewer seats than expected, it means they will be forced to listen to more extreme members of the party, which may determine their priorities as a government.

The last time Labour was in power in 2010, Liam Byrne, the outgoing Chief Secretary to the Treasury, left the incoming Chief Secretary David Laws a note saying, “I’m afraid there is no money.”1 Against that backdrop, we doubt they will look to loosen the fiscal purse strings materially, supported by their manifesto. More public services spending is inevitable, but most expect Labour to pay for this with moderate tax increases, and there will be limits on fiscal easing. Spending will therefore be constrained by the limited fiscal headroom.2

From an investor’s perspective, given the high probability of a Labour victory, it is worth examining the potential impact and investment implications.

In a speech given in March 2023, Angela Rayner, Deputy Leader for the Labour Party, reaffirmed how the Labour Party remains committed to “working in partnership with businesses and trade unions to deliver a more prosperous and aspirational future for Britain”, underscoring Labour as both “pro-worker and pro-business.”3 She outlined a mission for sustainable growth, which will involve the government and companies working together to ensure both businesses and working people thrive. She also discussed plans to modernise the British labour market, ensure security resilience and fair pay.4

Delving deeper into sectors, Labour has promised to renationalise nearly all passenger rail services within five years. The new entity, Great British Railways (GBR) would take over service contracts currently held by private firms as they expire in coming years, eventually taking over responsibility for maintaining and improving rail infrastructure from Network Rail. Those remembering the track record of the old British Rail are not expecting any material improvements.

Sir Keir Starmer has said on his first day in office, Labour will end business rate tax relief and start charging VAT for private education.5 The aim of this policy is to lift educational standards across the state sector, but critics note this will put additional strain on the already stretched state education system.

Housing and homebuilders will likely benefit under a Labour government. The party has committed to deliver 1.5 million new homes over the next five years, a tall order indeed, supporting home ownership for first-time buyers.6 It resembles the 2017 Conservative pledge to build 300,000 new homes by the mid-2020s.7 Labour’s plan involves developing new towns with 40% affordable housing requirements and unlock development plans on some disused, low-quality greenbelt sites. These supply-side reforms aim to drive higher volumes and may give UK home builders a boost.

Labour also aims to draw closer to Europe on key foreign and security issues. It seems likely several deals such as mutual recognition of qualifications and possibly renewing student exchange schemes allowing for easier youth mobility are agreements Labour can push.

[1] BBC, http://news.bbc.co.uk/2/hi/uk_news/politics/8688470.stm

[2] Deutsche Bank

[3] Labour List, https://labourlist.org/2023/03/labour-is-pro-worker-and-pro-business-angela-rayners-speech-to-the-cbi/

[4] Labour, https://labour.org.uk/updates/stories/a-new-deal-for-working-people/

[5] Labour, https://labour.org.uk/missions/opportunity/

[6] Labour, https://labour.org.uk/missions/economic-growth/

[7] BBC, https://www.bbc.com/news/61407508

This communication is provided for information purposes only. The information presented herein provides a general update on market conditions and is not intended and should not be construed as an offer, invitation, solicitation or recommendation to buy or sell any specific investment or participate in any investment (or other) strategy. The subject of the communication is not a regulated investment. Past performance is not an indication of future performance and the value of investments and the income derived from them may fluctuate and you may not receive back the amount you originally invest. Although this document has been prepared on the basis of information we believe to be reliable, LGT Wealth Management UK LLP gives no representation or warranty in relation to the accuracy or completeness of the information presented herein. The information presented herein does not provide sufficient information on which to make an informed investment decision. No liability is accepted whatsoever by LGT Wealth Management UK LLP, employees and associated companies for any direct or consequential loss arising from this document.

LGT Wealth Management UK LLP is authorised and regulated by the Financial Conduct Authority in the United Kingdom.